1

January 11, 2019

Potential Flaws of Opportunity Zones Loom, as Do

Risks of Large-Scale Tax Avoidance

By Samantha Jacoby

The 2017 tax law created a new tax break to encourage investment in low-income areas

(“opportunity zones”) but, as high-profile Wall Street, Silicon Valley, and real estate investors rush

to profit from it, critics are raising sensible concerns about the policy:

• The law enabled state policymakers to designate relatively affluent areas as opportunity zones,

which could divert investment from truly disadvantaged communities.

• While the new tax break enables investors to accumulate more wealth, it includes no

requirements to ensure that local residents benefit from investments receiving the tax break.

Thus, this tax break could amount to a “subsidy for gentrification” in many areas instead of,

as intended, for providing housing and jobs for low-income communities.

1

• Potential loopholes in the law and an initial set of proposed Treasury regulations — which

investors are now lobbying to re-shape — could enable investors to secure the tax benefits

while generating little real economic activity in the opportunity zones. The scope of potential

tax avoidance — an issue that hasn’t received enough attention to date — will become clearer

as Treasury finalizes its first set of regulations and releases additional guidance on how to

comply with the law.

• The new tax break will cost an estimated $1.6 billion in lost federal revenue over ten years,

according to Congress’ Joint Committee on Taxation,

2

but the costs could be significantly

higher after the first decade because, as explained below, some of the most generous tax

benefits extend far into the future.

3

Moreover, the extent to which the $1.6 billion figure

accounts for large-scale tax avoidance isn’t clear.

1

Adam Looney, “Will Opportunity Zones Help Distressed Residents or Be a Tax Cut for Gentrification?” Brookings,

February 26, 2018, https://www.brookings.edu/blog/up-front/2018/02/26/will-opportunity-zones-help-distressed-

residents-or-be-a-tax-cut-for-gentrification/.

2

Joint Committee on Taxation, “Estimated Budget Effects of the Conference Agreement for H.R. 1, the ‘Tax Cuts and

Jobs Act,’” JCX-67-17, https://www.jct.gov/publications.html?func=startdown&id=5053.

3

The tax break has implications for state revenues as well. For example, capital gains tax breaks for investments in

opportunity zone funds typically will flow through to state income taxes and reduce state revenue as well because most

1275 First Street NE, Suite 1200

Washington, DC 20002

Tel: 202-408-1080

Fax: 202-408-1056

www.cbpp.org

2

For these reasons, the tax break risks exacerbating the three main flaws of the 2017 tax law itself:

it mainly benefits wealthy investors instead of workers and residents of distressed communities,

reduces federal revenues and makes our long-term fiscal challenges worse, and creates new

opportunities for tax avoidance.

4

Congress hastily drafted and passed the 2017 law without public hearings or broad expert input,

and the new tax break for opportunity zones was among the provisions that didn’t receive nearly the

attention they deserved. The President and Congress should take the time now to consider how to

ensure that the benefits of this new tax break go to those who need them most, rather than creating

“mini tax havens for the wealthy.”

5

In its upcoming rulemaking, Treasury should focus on limiting

investors’ ability to use opportunity zones to avoid taxes without undertaking any activity that could

potentially benefit distressed communities and their residents.

Who Can Invest in Opportunity Zones?

The opportunity zone provision offers tax benefits to investors with unrealized capital gains —

gains in the value of investments, like stock, that the government hasn’t yet taxed because investors

haven’t yet sold them. Under the provision, investors who sell such investments can defer the capital

gains taxes that are otherwise due by “rolling” the amount of the gains into funds (known as

opportunity zone funds) that would invest in opportunity zones.

Investors can take advantage of the new tax break for opportunity zones in up to three ways.

First, investors can defer taxes on their capital gains until 2027 if they invest their gains in

opportunity zone funds. Second, those who hold their opportunity zone investments for at least

seven years also will get a 15 percent cut in the capital gains taxes that they would otherwise pay (on

top of the generous tax break that the low capital gains tax rate already gives them).

Third, and

perhaps most significant, those who hold opportunity zone investments for at least ten years will get

a permanent capital gains tax exemption for all of the gains they realize on their opportunity zone

investments through 2047.

6

Due, in part, to the complexity of the opportunity zone rules, large investment funds that raise

capital from individual investors will create and manage most opportunity zone funds. These

states piggyback on federal definitions of taxable income to define state taxable income. Also, most states have already

adopted the opportunity zone tax breaks — either because they automatically adopt all federal changes in the definition

of gross income as they occur or because they have taken deliberate action to adopt the 2017 tax law’s new gross income

definition. (See a map of state income tax conformity to opportunity zone tax breaks at

https://www.novoco.com/resource-centers/opportunity-zone-resource-center/guidance/state-tax-code-conformity-

personal-income.) Several other states will likely take similar action in 2019.

4

Chuck Marr, Brendan Duke, and Chye-Ching Huang, “New Tax Law Is Fundamentally Flawed and Will Require Basic

Restructuring,” Center on Budget and Policy Priorities, August 14, 2018, https://www.cbpp.org/research/federal-

tax/new-tax-law-is-fundamentally-flawed-and-will-require-basic-restructuring.

5

Gbenga Ajilore, “How a Tax Break Meant for Low-Income Communities Became a Mini Tax Haven for the Rich,”

Talk Poverty, December 13, 2018, https://talkpoverty.org/2018/12/13/tax-break-low-income-opportunity-rich/.

6

An investor must invest in opportunity zones by December 31, 2019 to obtain the full benefit of the tax break, because

opportunity zone investments must be held for seven years to qualify for the full 15 percent cut in capital gains taxes and

investors must realize their deferred capital gain by 2027. Investors can still benefit from tax forgiveness on appreciation

in opportunity zone investments if they invest after 2019, as long as they do so by December 31, 2026.

3

investment funds will select the investments, and investment structures, that offer the best prospects

for financial returns while satisfying the opportunity zone criteria.

7

Under the rules, opportunity zone funds must invest 90 percent of the capital they raise from

investors in the following types of property:

• physical assets, such as real estate or equipment, that are located in opportunity zones; and/or

• ownership interests, such as stock, of businesses that operate at least partially in opportunity

zones (referred to as opportunity zone businesses), including subsidiaries of larger businesses

that largely operate elsewhere.

8

The other 10 percent of capital that an opportunity zone fund raises isn’t subject to any

restrictions so, for example, it could invest in physical property that’s located outside of an

opportunity zone.

Some opportunity zones will choose to invest solely in opportunity zone businesses, while others

will choose to own assets, such as real estate, in opportunity zones rather than acquire ownership

interests in opportunity zone firms. Still others will choose some combination of both. Different

requirements apply to the ownership of each type of property, however. Opportunity zone

businesses, for example, may not operate certain types of businesses (such as so-called “sin”

businesses like massage parlors, gambling facilities, or liquor stores), but the rules don’t prevent an

opportunity zone fund from, say, directly owning and operating a casino. Like other distinctions,

this one rests on no obvious policy rationale.

Furthermore, many of the requirements are ambiguous. One rule, for instance, requires that

opportunity zone businesses “derive” at least half of their overall income from an “active business”

located in an opportunity zone. Neither the law nor the proposed regulations define the terms

“derive” or “active business.” Such ambiguity creates a wealth of opportunities for fund managers to

game the system as they plan their investment structures, such as by stretching the boundaries of

what the term “active business” means. In addition, and as discussed below, opportunity zone

investment may not significantly benefit low-income communities — supposedly the target of the

opportunity zones — whether the zone funds own assets directly, acquire ownership shares in

opportunity zone businesses, or some combination of the two.

Designation of Opportunity Zones Failed to Target Neediest Places

Since policymakers enacted the 2017 tax law, governors (and the District of Columbia’s mayor)

have designated about 8,700 opportunity zones in states and territories, including Puerto Rico.

Governors, who have now completed the selection process, had to choose most of these zones

from localities that qualify as “low-income communities,” meaning that they have either a poverty

7

For example, Goldman Sachs has already invested in opportunity zones, and Wells Fargo and J.P. Morgan Chase & Co.

are strategizing and planning to invest. Richard Rubin and Ruth Simon, “Rich Investors Eye Tax-Favored Development

Funds,” Wall Street Journal, November 14, 2018, https://www.wsj.com/articles/rich-investors-eye-tax-favored-

development-funds-1542193201; Timothy Weaver, “The Problem With Opportunity Zones,” CityLab, May 16, 2018,

https://www.citylab.com/equity/2018/05/the-problem-with-opportunity-zones/560510/.

8

For additional detail on these and other requirements, please see the Appendix.

4

rate of at least 20 percent or a median income that’s no greater than 80 percent of the median

income in their metropolitan area.

This definition of “low-income community” is broad enough to include some areas that are not

truly distressed, such as areas adjacent to some elite colleges — for example, the University of

Virginia and the University of California at Berkeley, where a large concentration of students skews

the income data. Furthermore, the law lets governors designate a subset of areas that are adjacent to

a low-income community and have a median income of no more than 125 percent of the median

income of the adjacent low-income community. Thus, they could designate as opportunity zones a

number of areas that many would not consider “distressed” — including Long Island City, where

Amazon is moving one of its new headquarters.

9

Opportunity zone advocates note that, on average, designated opportunity zones have a higher

poverty rate and lower household income than the national averages, but those averages mask an

important fact: While most opportunity zones do face above-average levels of economic distress,

many of the selected tracts are relatively affluent or have other structural advantages that made them

ripe for investment even before the new tax break was created.

10

For example, rapidly gentrifying

areas of Oakland, Los Angeles, and New York City have qualified as opportunity zones, as has part

of the Las Vegas Strip where a new NFL stadium is expected.

11

While such areas may represent a

small share of opportunity zones, the rules don’t prohibit opportunity zone funds from investing

exclusively in the most affluent zones. Thus, these “outlier” zones could attract a significant share of

the opportunity zone investment and come to account for a disproportionate share of the lost

federal revenue.

Program Mechanics Don’t Guarantee Local Residents Will Benefit

Because taxpayers must have unrealized capital gains to invest in an opportunity zone, and capital

gains are heavily concentrated among the wealthy, the tax break will directly benefit wealthy private

investors. Local residents of opportunity zones will benefit only to the extent that the tax break

encourages new investments (not those that would have occurred anyway); creates jobs for

residents; spurs the development of new, affordable housing; or creates broader economic

improvements that reach local residents.

Unlike some other economic development incentives, however, this tax break does not include

rules or tests requiring its direct beneficiaries to make specific investments that actually produce

public benefits or requiring that opportunity zone businesses hire workers from, or provide services

to, the local community. If anything, its incentives push in the opposite direction: the tax break is

worth the most with respect to investments whose value rises the fastest. As a result, investors will

9

Jim Tankersley, “Amazon’s New York Home Qualifies as ‘Distressed’ Under Federal Tax Law,” New York Times,

November 14, 2018, https://www.nytimes.com/2018/11/14/us/politics/amazon-hq2-long-island-city.html.

10

Center for American Progress, opportunity zone comment letter, https://www.regulations.gov/document?D=IRS-

2018-0029-0056.

11

Katherine Jarvis and Lesley Marin, “New Federal Program Seeks to Encourage Economic Development in Nevada

Low-Income Neighborhoods,” KTNV Las Vegas, May 4, 2018, https://www.ktnv.com/news/new-federal-program-

seeks-to-encourage-economic-development-in-nevada-low-income-neighborhoods.

5

likely select investments — such as luxury hotels rather than affordable housing — based mainly on

their expected financial return, not their social impact.

12

Indeed, in pitching to potential investors, former Trump White House Communications Director

Anthony Scaramucci characterized one of his investment firm’s projects in an opportunity zone in

Oakland as “building a swank, boutique hotel that’s going to create excessive economic rents.”

13

Similarly, Cadre, a New-York-based real estate investment firm, announced plans to invest only in a

subset of opportunity zones in metropolitan areas with “outsized future growth potential” — in

other words, in cities that are already expected to grow economically and likely don’t need help in

attracting investment.

14

Not surprisingly, then, analysts warn that the new tax break could accelerate

gentrification — and, hence, the dislocation of current residents — and create few jobs.

15

As noted, the law requires that opportunity zone businesses “derive” at least half of their income

from an “active business” in a zone. Neither the law nor the regulations, however, explain what that

means. Consider the following: A large, multinational software company that’s headquartered in

Silicon Valley locates a new subsidiary in an opportunity zone and moves a handful of its existing

software developers into the subsidiary, but it continues to employ most of its workers outside of

opportunity zones. The subsidiary earns income by licensing software that’s developed in part in the

opportunity zone back to the parent company in Silicon Valley, which then sub-licenses it to customers

around the world. Is the company’s resulting income “derived” from a business in the opportunity

zone? As Treasury develops additional regulations clarifying this and other ambiguities, it should do

so in ways that provide the greatest benefit for local residents.

Ambiguous, Arbitrary Rules Raise Questions of Tax Avoidance

Opportunity zones also bring the potential for loopholes that encourage tax sheltering and other

forms of tax avoidance. As a starting point, the proposed regulations let an investor get the full tax

break even if only 63 percent of the total capital that an opportunity zone fund invests flows to a

zone.

16

Beyond that, pure gaming could limit investment in opportunity zones even more. For instance,

there is a question about the extent to which a firm that relies on intangible property, such as

intellectual property — which is typical for a technology startup or pharmaceutical company — can

12

Ruth Simon and Richard Rubin, “New Hotel or Affordable Housing? Race Is On to Define ‘Opportunity Zones,’”

Wall Street Journal, July 13, 2018, https://www.wsj.com/articles/new-hotel-or-affordable-housing-race-is-on-to-define-

opportunity-zones-1531474200.

13

Noah Buhayar, “Scaramucci Pitches ‘Swank’ Hotel for Tax Cut Aimed at Poor Areas,” Bloomberg, December 12,

2018, https://www.bloomberg.com/news/articles/2018-12-12/scaramucci-pitches-swank-hotel-for-tax-cut-aimed-at-

poor-areas.

14

Charlie Anastasi, “Opportunity Zones: Moving from Reaction to Action,” Cadre,

https://cadre.com/insights/opportunity-zones-moving-from-reaction-to-action/.

15

Tatiana Kimbo and Richard Phillips, “How Opportunity Zones Benefit Investors and Promote Displacement,”

Institute on Taxation and Economic Policy, August 10, 2018, https://itep.org/how-opportunity-zones-benefit-

investors-and-promote-displacement/.

16

See Richard Rubin, “New ‘Opportunity Zone’ Tax-Break Rules Offer Flexibility to Developers,” Wall Street Journal,

October 19, 2018, https://www.wsj.com/articles/new-opportunity-zone-tax-break-rules-offer-flexibility-to-developers-

1539948600.

6

use accounting or other gimmicks to make it appear that it developed the intangible property in an

opportunity zone, even if the actual location of the company’s activities hasn’t changed much. Such

a maneuver could enable the company’s investors to avoid taxes on any gain in the value of their

intangible property.

The scope of such gaming will depend in part on how Treasury regulations interpret several of the

law’s vague requirements, including that businesses locate certain amounts of physical property

(such as real estate and equipment) in the zone, that a certain amount of intangible property be used

in an active business in an opportunity zone, and, as discussed above, that a certain amount of

income earned by opportunity zone subsidiaries be “derived” from the active operation of a

business in an opportunity zone (as opposed to investors merely, or “passively,” holding assets

located in a zone). Treasury should mitigate potential abuses by issuing regulations that limit

investors’ ability to extract tax breaks from opportunity zones that don’t result from real investments

in them.

Treasury regulations cannot prevent all abuse, however; many tax avoidance opportunities are

inherent in the tax break itself. As noted in the Appendix, for instance, the law imposes vastly

different requirements with regard to opportunity zone funds that contribute capital to opportunity

zone businesses, as distinguished from an opportunity zone fund that directly owns physical assets

in an opportunity zone. That will likely encourage investors to game the rules and take advantage of

the tax break in any possible way.

Conclusion

The direct tax benefits of opportunity zones will flow overwhelmingly to wealthy investors, but

the tax break might not do much to help low-income communities, and it could even harm some

current residents of such communities.

In the near term, Treasury should issue regulations that reduce the potential for opportunity zones

to serve as pure tax shelters. Regulatory ambiguity in what constitutes qualifying activity in an

opportunity zone could open the door for large-scale tax avoidance. Regulatory fixes alone,

however, can’t address the problems that stem from a law that gives governors and investors

substantial leeway to determine what investments qualify for the tax break. Accordingly, Congress

should exercise its oversight authority to carefully consider how the program is working, who is

actually benefitting, and how it can prevent widespread tax avoidance — and policymakers should

make appropriate adjustments to the law based on the findings.

7

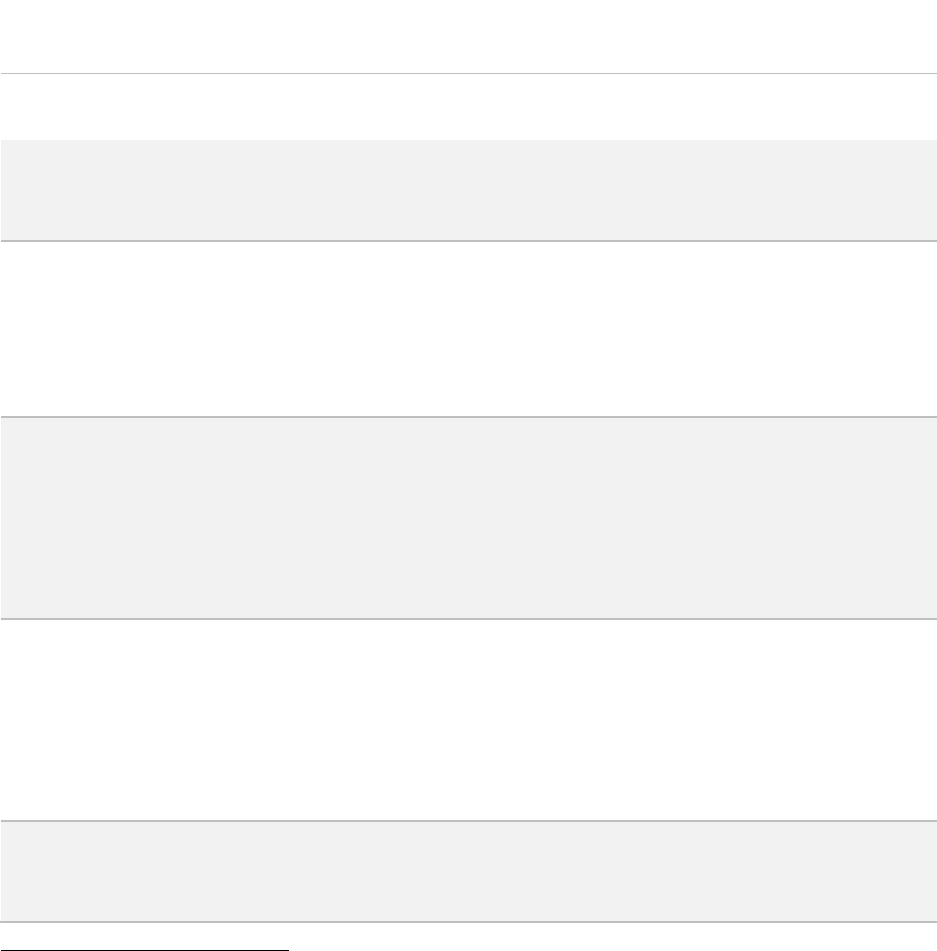

Appendix: Requirements Applicable to Opportunity Zone Funds

As discussed above, opportunity zone funds must satisfy several conditions to secure tax breaks

for their investors. The table below summarizes certain requirements for opportunity zone funds

that (1) purchase ownership interests in businesses that operate at least partially in opportunity zones

(“opportunity zone businesses”) or (2) invest directly in tangible assets (e.g., real estate) located in an

opportunity zone. For ease of analysis, the table assumes that the opportunity zone fund invests in

one or the other, but not both.

APPENDIX TABLE 1

Requirements for Two Basic Opportunity Zone Fund Structures

17

Opportunity Zone Fund Invests in

Opportunity Zone Businesses

Opportunity Zone Fund Directly

Owns Assets in an Opportunity Zone

Asset Test

At least 70% of an opportunity zone

business’s tangible property (e.g., real

estate or equipment) must be located in

an opportunity zone.

At least 90% of the fund’s assets

must be located in an opportunity

zone.

Income

Requirement

At least half of the opportunity zone

business’s income must be “derived”

from the “active conduct of a business” in

the zone, as opposed to investors merely

(that is, passively) holding assets (though

the Treasury Department will need to

further define these terms).

No such requirement.

Intangible

Property

Limitations

There is no overall limit on the amount of

intangible property (e.g., intellectual

property) that the opportunity zone

business can own, but a “substantial

portion” of its intangible property must be

used in the “active conduct of a

business” in a zone (though Treasury will

need to further define these terms).

Only up to 10% of a fund’s property

(and any cash and property that’s

not located in an opportunity zone)

can be intangible property, but there

is no requirement that a percentage

of a fund’s intangible property be

related to the active business of the

fund.

Financial

Property

Restrictions

The opportunity zone business can hold a

“reasonable” amount of cash — in fact,

more than 30% of its assets, which would

override the asset test described in the

first box in this column — if the business

shows that it has a plan for spending the

money and uses the funds within a

specified time period.

Cash (together with any intangible

assets and any assets located

outside the opportunity zone) can’t

exceed 10% of the fund’s assets.

Prohibited

Activities

An opportunity zone business may not

operate certain “sin” businesses (golf

courses, liquor stores, spas, etc.).

Opportunity zone funds may operate

sin businesses directly (rather than

owning a company that runs a sin

business).

17

The requirements described in this table are based on the law and proposed Treasury regulations. These are not the

only requirements that apply to opportunity zone funds. Here, we describe only the requirements in which there are

significant differences based on whether an opportunity zone fund invests mainly in opportunity zone businesses or

directly owns assets in an opportunity zone.

8

Treatment of

Movable

Property

Movable tangible property (e.g., cars or

boats) that an opportunity zone business

removes from an opportunity zone can

still count toward the asset test for 5

years.

This rule does not appear to apply to

property that a fund holds directly.

That is, property removed from an

opportunity zone no longer satisfies

the asset test.

Although some opportunity zone funds will choose to invest solely in opportunity zone

businesses and others will choose to own assets, such as real estate, in opportunity zones, rather

than acquire ownership interests in opportunity zone businesses, still others will choose a

combination of both. In all cases, as discussed in the report, 90 percent of an opportunity zone

fund’s capital must be invested in some combination of tangible assets in opportunity zones and

companies that qualify as opportunity zone businesses.