U.S. Department of the Interior Tribal Economic Development Principles-at-a-Glance Series

Assistant Secretary-Indian Affairs Opportunity Zones in Indian Country

Office of Indian Energy and Economic Development

Division of Economic Development

Tribal Economic Development Principles-at-a-Glance Series

Opportunity Zones in Indian Country

Tribal Economic Development Principles at a Glance Series

Opportunity Zones

Assistant Secretary – Indian Affairs

Office of Indian Energy and Economic Development 2 Division of Economic Development

Tribal Economic Development Principles-at-a-Glance Series

Opportunity Zones and Indian Country

This is the 18th in a series of economic development primers produced by the Division of

Economic Development (DED), Office of Indian Energy and Economic Development (IEED), to

offer answers to fundamental questions about creating jobs and expanding economies in tribal

communities.

Nothing in this primer is intended, nor should it be relied upon, as legal advice. Rather, it is

meant to acquaint tribal governments with the fundamentals of Opportunity Zones, and to better

equip them to work with legal and tax professionals they retain to harness the tax benefits of

creating or expanding tribal businesses in such areas.

If you would like to discuss Opportunity Zones and their impact on Indian Country in more

detail, please contact the DED at (202) 208-0740.

What is an Opportunity Zone?

An Opportunity Zone is an economically-distressed community where new investments may be

eligible for certain tax benefits.

1

Opportunity Zones were created under the Tax Cuts and Job

Acts of 2017 (Public Law No. 115-97) as a tool to spur economic development and job creation

in eligible low-income areas which have difficulty attracting new businesses and jobs. There are

8,762 Opportunity Zones spread throughout the 50 states, the District of Columbia, and five U.S.

territories (American Samoa, Guam, the Northern Mariana Islands, Puerto Rico, and the U.S.

Virgin Islands).

2

Individuals and corporations that sell investments at a profit can, in turn, invest

realized capital gains from such sales in businesses or property in Opportunity Zones and defer

paying capital gains tax for up to 10 years.

How did eligible low-income areas become Opportunity Zones?

In 2018 the U.S. Internal Revenue Service (“IRS”) identified low-income community tracts that

qualified for designation as Opportunity Zones. A “low-income community” means any

population census tract where:

- the poverty rate for the tract is at least 20 percent;

1

26 U.S.C. §1400Z-1(a); Internal Revenue Service (“IRS”), Opportunity Zones Frequently Asked Questions, IRS.

2

IRS, Internal Revenue Bulletin Notice 2018-48 (Nov. 21, 2018), Designated Qualified Opportunity Zones under

Internal Revenue Code § 1400Z-2, IRS

.

Tribal Economic Development Principles at a Glance Series

Opportunity Zones

Assistant Secretary – Indian Affairs

Office of Indian Energy and Economic Development 3 Division of Economic Development

- the median family income for a tract not located within a metropolitan area does not

exceed 80 percent of statewide median family income; or

- the median family income for a tract located within a metropolitan area does not

exceed 80 percent of the greater of statewide median family income or the

metropolitan area median family income.

3

Areas adjacent to eligible low-income communities that did not meet the definition of “low-

income community” themselves were still eligible for designation, provided the median family

income of the adjacent area did not exceed 125 percent of the median family income of the

neighboring eligible low-income community.

4

The IRS then turned the nomination process over to state and territorial governors, and the mayor

of the District of Columbia. Each then nominated a maximum of 25 percent of the eligible areas

in their respective state/territory to be designated as opportunity zones.

5

Aside from the

limitations set by the IRS on what areas qualified for nomination and designation, governors

were free to pick whichever eligible areas they wanted to be designated as Opportunity Zones.

Governors followed their own processes for deciding on what areas to nominate for designation.

In Montana, for example, the governor nominated 25 areas for designation after reviewing

proposals from eligible communities, including 7 federally recognized American Indian

reservations.

6

The U.S. Treasury Department (“Treasury”) finalized the designations at the end of 2018. A full

list of designated Opportunity Zones is available online in spreadsheet format. An interactive

map of all designated Opportunity Zones is also available online.

Are there any opportunity zones in Indian Country?

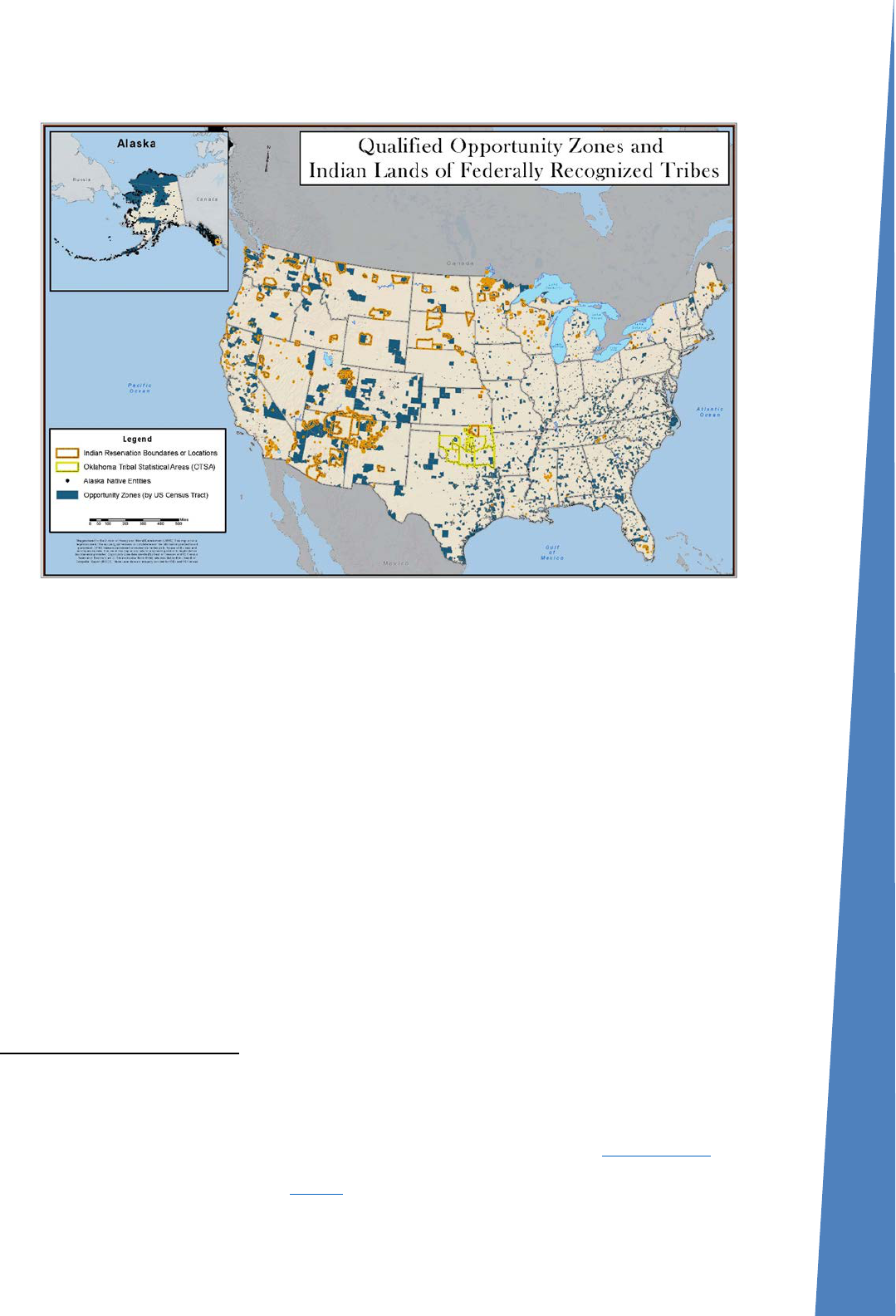

Yes. There are 362 Opportunity Zones that overlap with Indian tribal lands, including state and

federally recognized American Indian and Alaska Native reservations and trust lands, Alaska

Native villages, and tribal areas in Oklahoma. Unfortunately, because of the statutory limit on

the number of eligible areas that could be nominated for designation, some of the poorest areas

of Indian Country were not deemed as such despite being eligible.

3

26 U.S.C. §§ 45D(e), 1400Z-1(c)(1).

4

Id. at §1400Z-1(e)(1).

5

IRS Rev. Proc. 2016-16 (Feb. 28, 2018), IRS.

6

“Governor Bullock Sends Opportunity Zone Nominations to U.S. Treasury”, Montana Department of Commerce,

April 23, 2018, Montana Department of Commerce

.

Tribal Economic Development Principles at a Glance Series

Opportunity Zones

Assistant Secretary – Indian Affairs

Office of Indian Energy and Economic Development 4 Division of Economic Development

(Map showing overlay of Opportunity Zones and Indian Tribal Lands)

7

How long will a designated area remain an Opportunity Zone?

Designations last for 10 years from the date of designation.

8

How does investing in an Opportunity Zone work?

In order to invest in an Opportunity Zone, investors pool their investments in an Opportunity

Fund, which is an investment vehicle set up either as a partnership or corporation, for investing

in eligible property or businesses located in an Opportunity Zone.

9

Only a partnership or

corporation organized in one of the 50 states, the District of Columbia, or U.S. territories is

eligible to be an Opportunity Fund.

10

Opportunity Funds must hold at least 90 percent of their

assets in Opportunity Zone Property meaning tangible business property or stock or partnership

interest in a business located in an Opportunity Zone.

11

Opportunity Funds must self-certify on IRS Form 8996 in their annual income tax filings. There

are already at least 134 funds across the U.S. with $29 billion in capital.

12

7

Map of Qualified Opportunity Zones and Indian Lands of Federally Recognized Tribes, Assistant Secretary -

Indian Affairs, Office of Indian Energy and Economic Development, Division of Energy and Mineral Development.

8

26 U.S.C. § 1400Z-1(f).

9

Id. at § 1400Z-2(d).

10

Investing in Qualified Opportunity Funds, 83 Fed. Reg. 209 (October 29, 2018), 54296, Federal Register.

11

26 U.S.C. § 1400Z-2(d)(1).

12

Novogradac, Opportunity Funds Listing, Novoco.

Tribal Economic Development Principles at a Glance Series

Opportunity Zones

Assistant Secretary – Indian Affairs

Office of Indian Energy and Economic Development 5 Division of Economic Development

The primary source of investments for Opportunity Funds are capital gains.

What is a capital gain and what kinds of capital gains can be invested in an Opportunity

Fund?

A capital gain is the difference between what a person or corporation paid for an asset and the

amount of profit received when the asset is sold. Under regulations proposed by the IRS, almost

any kind of capital gain can be invested in an Opportunity Fund, including profits from the sale

of stocks, mutual funds, real estate, or a business.

13

If a seller reinvests the capital gains in an

Opportunity Fund within 180 days of the sale, they can defer paying taxes on them.

For example, if a stock is sold for $400,000 and $200,000 of that amount was a gain, the seller

could then reinvest the gain in an Opportunity Fund and defer their capital gains tax. The seller

can do what they like with the remaining $200,000. Only the gains may be reinvested in the

Opportunity Fund in order for the seller to defer paying capital gains taxes on it.

Is there a limit on the amount of capital gains that can be invested in an Opportunity

Fund?

No.

Can a tribal government set up an Opportunity Fund?

Yes, by chartering a partnership or corporation that is eligible to be an Opportunity Fund.

14

Tribes should note, however, that an Opportunity Fund will be subject to Federal income tax

regardless of the laws under which it is established or organized.

15

What is an Opportunity Zone business?

An Opportunity Zone business means a trade or business in which:

- substantially all of the tangible property owned or leased is Opportunity Zone

business property;

- fifty percent of the total gross income of the business is derived from the active

conduct of the business;

- a substantial portion of the intangible property of the business is used in the active

conduct of the business; and

13

Supra. Note 8 at 54279.

14

Investing in Qualified Opportunity Funds, 84 Fed. Reg. 84 (May 1, 2019), 18669, Federal Register.

15

Id.

Tribal Economic Development Principles at a Glance Series

Opportunity Zones

Assistant Secretary – Indian Affairs

Office of Indian Energy and Economic Development 6 Division of Economic Development

- less than five percent of the average of the aggregate unadjusted bases of the property

of such entity is attributable to nonqualified financial property.

16

The following do not qualify as Opportunity Zone businesses:

- private or commercial golf courses;

- country clubs;

- massage parlors;

- hot tub facilities;

- suntan facilities;

- racetracks or other facilities used for gambling; or

- any store where the principal business is the sale of alcoholic beverages for off-site

consumption.

17

What is Opportunity Zone business property?

Opportunity Zone business property means tangible property used in a trade or business of an

Opportunity Fund where:

- the property was acquired after December 31, 2017;

- the original use of such property commences with the Opportunity Fund or the fund

substantially improves the property; and

- during substantially all of the fund’s holding periods of the property, substantially all

of the use of the property was in a qualified Opportunity Zone.

18

Additionally, inventory of an Opportunity Fund, such as raw materials, meets the definition of

tangible property even when it is in transit from a vendor or to a customer.

Will Indian trust land qualify as Opportunity Zone business property?

Yes. The IRS has proposed regulations that deal directly with the unique features of Indian trust

land that is typically leased to tribal businesses or tribal members. According to the proposed

regulations, leased property will be treated as Opportunity Zone business property if:

- the leased property was acquired under a lease after December 31, 2017; and

16

26 U.S.C. §§ 1397C(b)(2), (4), (8), 1400Z-2(d)(3). The meaning of “substantially all” throughout the statute and

proposed regulations depends on the context where it is used. In the context of the amount of tangible property

owned or leased by the business, the meaning is 70 percent.

17

Supra. Note 10 at 54296.

18

Id. at § 1400Z-2(d)(2)(D). The meaning of “substantially all” throughout the statute and proposed regulations

depends on the context where it is used. In the context of the use of opportunity zone business property, the meaning

is 70 percent.

Tribal Economic Development Principles at a Glance Series

Opportunity Zones

Assistant Secretary – Indian Affairs

Office of Indian Energy and Economic Development 7 Division of Economic Development

- substantially all of the use of the leased property is in an Opportunity Zone during

substantially all of the period for which the business leases the property.

19

Unlike with tangible property acquired through purchase, the proposed regulations will not

impose an “original use” requirement on leased property because, in most circumstances, leased

property cannot be placed in service for depreciation or amortization purposes as the lessee does

not own the leased property.

20

As such, leased property also will not be subject to the

“substantially improved” requirement for purchased property. Finally, the proposed regulations

will not require leased property to be acquired from a lessor that is unrelated to the Opportunity

Fund or the business that is the lessee.

Can a business located within an Opportunity Zone sell products to customers outside of

the zone and still be considered an Opportunity Zone business?

Yes. A business located in an Opportunity Zone can sell its products to customers outside the

zone provided it derives at least 50 percent of its total gross income from the active conduct of

the business within the zone.

21

The IRS proposed a gross receipts test consisting of three safe

harbors for businesses to determine if they satisfy the 50 percent gross income requirement.

Businesses only need to meet one of the following safe harbors to satisfy the test:

- based on number of hours the services are performed, at least 50 percent of the

services performed by employees and/or independent contractors are within the

Opportunity Zone;

- based on the amounts paid for the services, at least 50 percent are performed within

the Opportunity Zone; or

- the tangible property of the business located within the Opportunity Zone and the

management or operational functions performed for the business in the zone are each

necessary to generate 50 percent of the gross income of the trade or business.

22

Additionally, the IRS’s proposed regulations include a facts-and-circumstance test for businesses

that cannot meet any of the safe harbor tests.

23

An Opportunity Zone business can meet this test

if, based on all the facts and circumstances, at least 50 percent of its gross income is derived

from the active conduct of its trade or business in the Opportunity Zone.

19

Supra. Note 14 at 18653-18654.

20

Id.

21

26 U.S.C §§ 1400Z-2(d)(3)(A)(ii) and 1397C(b)(2).

22

Supra. Note 14 at 18658-18659.

23

Id.

Tribal Economic Development Principles at a Glance Series

Opportunity Zones

Assistant Secretary – Indian Affairs

Office of Indian Energy and Economic Development 8 Division of Economic Development

What are the benefits of investing in an Opportunity Fund?

Investors in Opportunity Funds can defer recognizing capital gains on their tax returns until they

either divest their interest in the fund or until December 26, 2026, whichever comes first. Certain

portions of the capital gain can also be forgiven based on the length of time it is invested in an

Opportunity Fund. For example, if an investor stays in the fund for at least five years, then 10

percent of the deferred tax gain is forgiven, and an additional 5 percent of the deferred gain is

forgiven if they stay invested for seven years.

24

Any profit earned on an investment in the new

fund is tax free after it remains in the fund for ten years, but the investor would still have to pay

taxes on the original gain that was rolled into the fund by December 26, 2026.

State tax incentives may also be available to investors in Opportunity Funds. Check with your

state’s tax office for more information.

What benefits do Opportunity Zones bring to Indian Country?

Opportunity Zones offer Indian Country an important new tool with which to attract investments

in a wide range of projects to improve the economic conditions on tribal lands. There are

potentially millions of dollars in investments which could be attracted to areas throughout Indian

Country that have been designated as Opportunity Zones. As stated earlier, Opportunity Funds

must hold at least 90 percent of their assets in Opportunity Zone property, which can include

stock or equity in businesses. Tribally owned businesses already operating within an Opportunity

Zone could seek new investments to further expand, or new businesses could be established.

Opportunity Funds can also choose to hold their assets in tangible property within an

Opportunity Zone, which could lead to the development or redevelopment of properties within

Indian Country. This could attract new investments for the construction of new buildings or the

redevelopment of existing buildings, such as warehouses, office buildings, hotels, or apartment

buildings, thereby leading to an increase in jobs in the Opportunity Zone area. The potential

impacts of constructing or redeveloping properties in Indian Country might include the creation

of other, new secondary businesses, such as coffee shops or restaurants, that while not direct

recipients of Opportunity Funds, support Opportunity Zone businesses. One can foresee that the

construction of an office park, for example, could lead to new businesses, such as coffee shops or

dry cleaners, being established nearby to serve the persons working in there.

Finally, since there is no fixed ceiling on the number of Opportunity Zones that can receive

investments in any given year, all eligible zones can receive any amount of capital through

Opportunity Funds during the year. This represents a new way for Indian Country to attract

24

Id. at §1400Z-2(b).

Tribal Economic Development Principles at a Glance Series

Opportunity Zones

Assistant Secretary – Indian Affairs

Office of Indian Energy and Economic Development 9 Division of Economic Development

financing for projects that would improve the economic outlook of the Opportunity Zone area,

and, by extension, the tribe and its members.

Are there any downsides to Opportunity Zones?

There are still many areas throughout Indian Country that meet the definition of low-income that

were not, and will not be, designated as Opportunity Zones because each state and territory has

nominated their maximum number of eligible areas and there will be no an opportunity for

additional or revised designations.

25

If the program is successful in attracting new investments to

Opportunity Zones in Indian Country, the disparities between tribal areas will become more

apparent.

How do Opportunity Zones differ from the New Market Tax Credit program?

The New Market Tax Credit (“NMTC”) Program and the Opportunity Zone program both seek

to solve the same problem, but in different ways. While both provide tax benefits to investors

who funnel capital into economically distressed communities, there are important distinctions

between them. For example, while there are a limited number of NMTC tax-credits available

each year, there is no limit on the number of Opportunity Funds that can be created in a year.

Also, the NMTC program involves outcome-based reporting and compliance requirements, with

applications evaluated on various factors, including the potential impact investments will have

on benefits to low-income persons and jobs. While the Opportunity Zone program requires

business property to be “substantially improved”, there are no reporting requirements related to

the direct impacts on the Opportunity Zone area.

Where can I find more information about opportunity zones?

The IRS and the Community Development Financial Institution Fund (“CDFI Fund”) provide a

variety of resources about Opportunity Zones. For more information, including on the IRS’s

proposed regulations addressing Indian trust land in Opportunity Zones, visit the following

websites;

• IRS website – Click Here

• CDFI Fund website – Click Here

25

IRS Notice 2018-48, Designated Qualified Opportunity Zones under Internal Revenue Code §1400Z-2: IRS.