STATE OF NEW JERSEY DEPARTMENT OF

TRANSPORTATION

Right of Way

Acquisition Manual

Prepared by the

Division of Right of Way and Access Management

August 2019

TABLE OF CONTENTS

Section 1 Introduction ........................................................................ 1

1.1 Purpose and Use ...................................................................................................... 1

1.2 Manual Revisions and Updates ................................................................................... 1

1.3 Authority and Oversight ............................................................................................ 2

1.3.1 Operating Authority .................................................................................... 2

1.3.2 Oversight of the Right of Way Process ........................................................... 2

1.3.3 Right of Way & Access Management Division’s Right of Way Functions .............. 3

1.3.4 Conflict of Interest ..................................................................................... 4

1.3.5 Counsel..................................................................................................... 5

1.4 Definitions ............................................................................................................... 5

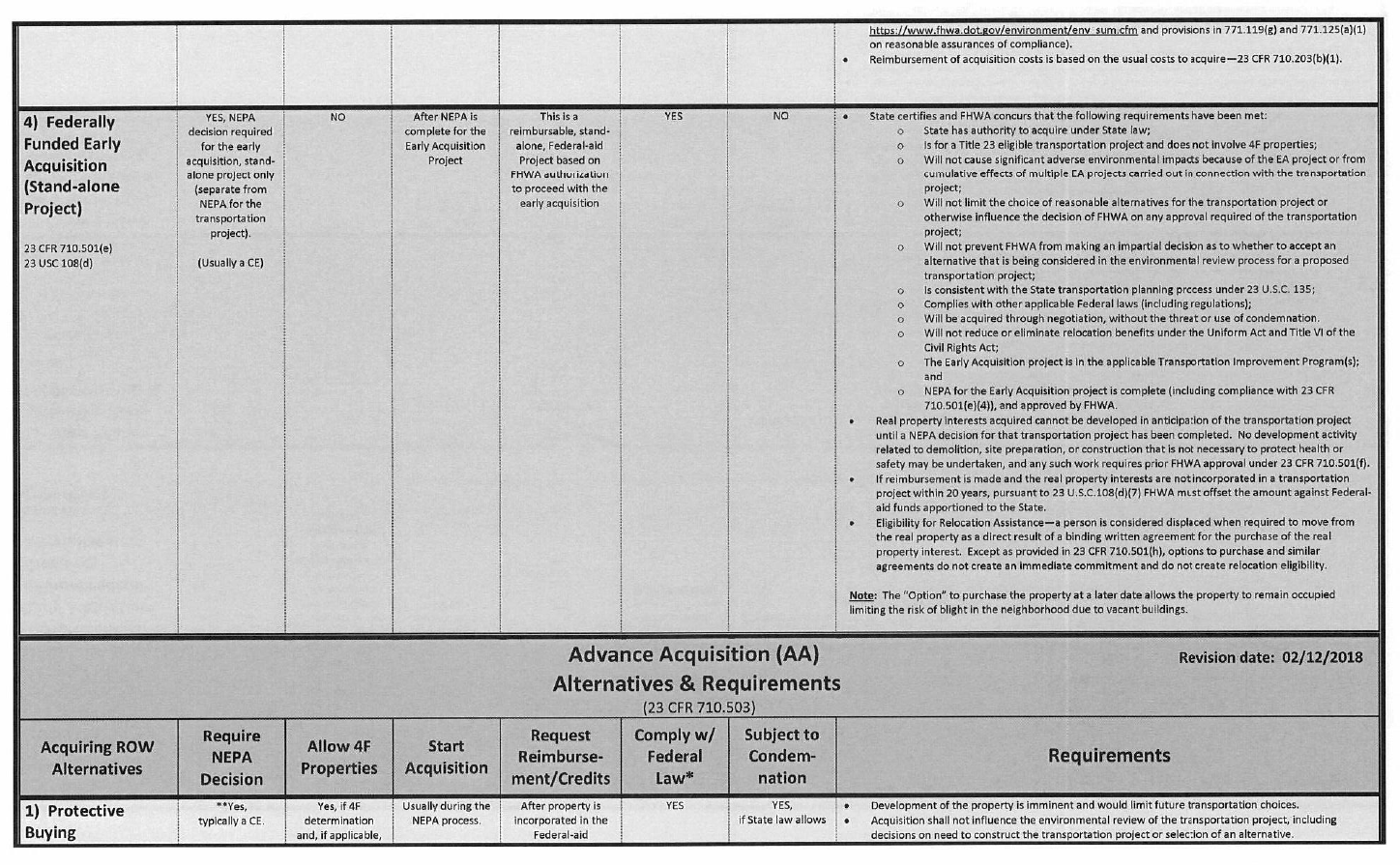

1.5 Early and Advance Acquisition.................................................................................. 12

1.6 Initial Project Responsibilities................................................................................... 12

1.6.1 Preliminary Engineering ............................................................................ 12

1.6.2 Transmittal of Project to District Office ........................................................ 12

1.6.3 Initial District Activities. ............................................................................ 13

1.7 Parcel Records ....................................................................................................... 14

Section 2 Appraisal and Review ......................................................... 15

2.1 Valuation Overview ................................................................................................ 15

2.1.1 Regulation of Valuation Function ................................................................ 15

2.1.2 Organization Overview for Valuation ........................................................... 16

2.2 Project Valuation Responsibilities ............................................................................. 17

2.2.1 Project Acquisition Phase ........................................................................... 18

2.2.2 Submitting Consultant Order Requests ........................................................ 22

2.2.3 Report Delivery ........................................................................................ 22

2.2.4 Report Review ......................................................................................... 23

2.2.5 Processing Consultant Payment Requests .................................................... 23

2.2.6 Project Assigned to a Full Service Right of Way Consultant ............................ 23

2.2.7 Registration of Case ................................................................................. 24

2.2.8 Pre Condemnation Revisions and Report Updates ......................................... 24

2.2.9 Pre Condemnation Update Offer of Just Compensation .................................. 25

2.2.10 Post Condemnation Update Requests .......................................................... 25

2.2.11 Miscellaneous Valuation and NRE Service Requests ....................................... 26

2.2.12 Reports to be provided to the Property Owner .............................................. 26

2.2.13 Presentation of ADV Offer to Owners/Agents ................................................ 26

2.2.14 Owner’s Request for an Appraisal (ADV Cases) ............................................ 26

2.2.15 Interagency Administrative Determinations of Value ..................................... 26

2.2.16 Administrative Determinations of Value in Condemnation .............................. 27

2.2.17 Appraising Green Acres, Farmland and Conservation Restrictions ................... 27

2.2.18 Appraisals required per parcel .................................................................... 27

2.2.19 Appraisals for Dedications and Donations .................................................... 27

2.3 Valuation Management ........................................................................................... 28

2.3.1 Consultant Pre-qualification List ................................................................. 28

2.3.2 Consultant Eligibility for Pre-qualification List ............................................... 28

2.3.3 Review of Prequalified Consultant List ......................................................... 29

2.3.4 Consultant Fee Guidance ........................................................................... 29

2.3.5 Additional Division Staff Functions .............................................................. 29

2.4 Quality Control ....................................................................................................... 30

2.5 General Valuation and NRE Background Information ................................................... 30

2.5.1 Date of Valuation & Date of Report ............................................................. 31

2.5.2 Benefits Resulting from a Project ................................................................ 32

2.5.3 Fixtures/Personalty & Functional Unit Items ................................................. 32

2.5.4 Highest and Best Use and Fair Market Value ................................................ 32

2.5.5 Compensability of Damages ....................................................................... 33

2.5.6 Business Losses ....................................................................................... 36

2.5.7 Changes in Grade ..................................................................................... 37

2.5.8 Drainage ................................................................................................. 37

2.5.9 Noise ...................................................................................................... 37

2.5.10 Landscaping / Crops and Sand Deposits ...................................................... 37

2.5.11 Visibility .................................................................................................. 38

2.5.12 Limits of Grading ...................................................................................... 38

2.5.13 Easements in General ............................................................................... 38

2.5.14 Encroachments ........................................................................................ 39

2.5.15 Environmental Conditions (Other Than Contamination) and Valuation ............. 40

2.5.16 Contaminated Property and Valuation ......................................................... 40

2.5.17 Mitigation of Severance Damages / Replacement Property ............................. 40

2.5.18 Tidelands ................................................................................................ 41

2.5.19 Green Acres and Farmland and Conservation Restricted Lands ....................... 41

2.5.20 Verification of Comparable Sales, Competent Knowledge Required ................. 41

2.6 Appraisal Requirements and Standards ..................................................................... 41

2.6.1 Appraiser Qualifications ............................................................................. 41

2.6.2 Information to be Furnished to Appraisers ................................................... 42

2.6.3 Submission and Review of Appraisal ........................................................... 43

2.6.4 Delivery and Review of Appraisal Addenda................................................... 43

2.6.5 Appraisal Testimony ................................................................................. 43

2.6.6 Ethical Standards Regarding Valuation Services ........................................... 43

2.6.7 Ownership of Report ................................................................................. 44

2.6.8 Report Corrections, Revisions, and Additions ............................................... 44

2.6.9 Regulatory Requirements and Standards for Valuation Reports ...................... 44

2.6.10 General Appraisal Standards ...................................................................... 47

2.6.11 Appraisal Report Documentation ................................................................ 50

2.7 Non Real Estate Report (NRE) Standards NJDOT Use of NRE Services ........................... 52

2.7.1 NRE Valuation Reports .............................................................................. 52

2.7.2 NRE Mitigation Reports ............................................................................. 52

2.7.3 NRE Consultant Qualifications .................................................................... 54

2.7.4 NRE Testimony ........................................................................................ 54

2.7.5 Ethical Standards of Service for NRE Providers ............................................. 54

2.7.6 Information to be furnished to NRE Specialists ............................................. 54

2.7.7 Maps & Map Errors or Omissions ................................................................ 54

2.7.8 Ownership of Reports ............................................................................... 55

2.7.9 Report Corrections, Revisions, and Additions ............................................... 55

2.7.10 NRE Report General Standards ................................................................... 55

2.7.11 NRE Report Format ................................................................................... 56

2.8 Administrative Determinations of Value ..................................................................... 56

2.8.1 Ethical Standards of Service for ADV Provider .............................................. 56

2.8.2 Ownership of Report ................................................................................. 56

2.8.3 Report Corrections, Revisions, and Additions ............................................... 56

2.8.4 Applicability ............................................................................................. 57

2.8.5 Preparation of Administrative Determinations of Value .................................. 57

2.8.6 Scope of Administrative Determinations of Value .......................................... 57

2.8.7 Level of Documentation for ADV ................................................................. 57

2.9 Standing Crop Valuations ........................................................................................ 57

2.10 Appraisal Review .................................................................................................... 58

2.10.1 Standards ............................................................................................... 58

2.10.2 Review Requirements ............................................................................... 58

2.10.3 Review Functions ..................................................................................... 58

2.10.4 Review Appraiser’s Delegated Authority ...................................................... 61

2.10.5 Registration & Re-Registration of the Estimated Just Compensation ................ 61

2.10.6 Ethical Standards of Service for Appraisal Review Providers ........................... 62

2.10.7 Ownership of Report ................................................................................. 62

2.10.8 Appraisal Review Report Corrections, Revisions, and Additions ....................... 62

2.11 Sample Report Formats ........................................................................................... 62

Section 3 Negotiations ...................................................................... 63

3.1 General ................................................................................................................. 63

3.2 Assignment of Negotiations ..................................................................................... 63

3.3 Realty Specialist Pre-Negotiations Activities ............................................................... 64

3.4 Negotiations with the Property Owner ....................................................................... 65

3.5 Special Negotiations ............................................................................................... 68

3.6 Realty Specialist’s Case Summary (call data) ............................................................. 69

3.7 Realty Specialist Responsibility/Authority .................................................................. 70

3.8 Administrative/Legal Settlements ............................................................................. 70

3.9 Standing Crop Payment Procedure ............................................................................ 71

3.10 Cemetery Property ................................................................................................. 72

3.11 Leases .................................................................................................................. 72

3.12 District Preparation of the Case for Agreement/Condemnation ..................................... 72

3.13 Processing of Case by Headquarters Technical Support ............................................... 74

3.14 Quality Control ....................................................................................................... 75

Section 4 Relocation & Property Management ................................... 76

4.1 Introduction .......................................................................................................... 76

4.1.1 General Requirements .............................................................................. 76

4.1.2 Public Information .................................................................................... 77

4.1.3 Relocation Brochure.................................................................................. 77

4.1.4 Relocation Information for Owner/Tenant Occupants ..................................... 77

4.1.5 Tracing Relocatees ................................................................................... 78

4.2 Relocation Planning ................................................................................................ 78

4.2.1 Individual Relocation Plan .......................................................................... 79

4.2.2 Locating a Satisfactory Unit ....................................................................... 79

4.2.3 Civil Rights .............................................................................................. 79

4.2.4 Relocation Housing/Business Summary and Lead Time Analysis ..................... 79

4.2.5 Local Site Office ....................................................................................... 79

4.2.6 Preparation of the Workable Relocation Assistance Plan ................................. 80

4.3 Temporary Displacement ......................................................................................... 81

4.4 Relocation Advisory Services ................................................................................... 82

4.4.1 Initial Personal Contact ............................................................................. 82

4.4.2 Relocation Call Data ................................................................................. 83

4.4.3 Relocation Records ................................................................................... 83

4.4.4 Annual Federal Reports ............................................................................. 84

4.5 Status of a Displacee in the United States ................................................................. 84

4.6 Department of Labor Mine Safety Act ........................................................................ 85

4.7 Residential Relocations ........................................................................................... 86

4.7.1 Special Replacement Housing Needs ........................................................... 86

4.7.2 Estimating and Developing Housing Resources ............................................. 86

4.7.3 Replacement Housing of Last Resort ........................................................... 86

4.7.4 Residential Relocation Services to be Provided ............................................. 87

4.7.5 Comparable Replacement Dwelling Determination ........................................ 87

4.7.6 Functional Dwelling Replacement Determination .......................................... 88

4.7.7 Public Housing ......................................................................................... 89

4.7.8 Residential Specific Relocation Definitions ................................................... 90

4.7.9 General Residential Information Notices ...................................................... 90

4.7.10 Inspection of Relocation Housing ................................................................ 91

4.7.11 Action to Correct Substandard Units ........................................................... 91

4.7.12 90-Day Notices and Subsequent 30-Day Notices .......................................... 91

4.7.13 Emergency Relocations ............................................................................. 91

4.8 Department Actions ................................................................................................ 92

4.9 Replacement Housing Payments for 90-Day Occupants ............................................... 92

4.9.1 Owner Occupant Eligibility ......................................................................... 92

4.9.2 Amount of Payment .................................................................................. 92

4.9.3 Computation of Price Differential ................................................................ 93

4.9.4 Determining the Cost of a Comparable Replacement Dwelling ........................ 93

4.9.5 Offering the Replacement Housing Payment ................................................ 94

4.9.6 Special Situations ..................................................................................... 94

4.9.7 Limitations on Payment ............................................................................. 95

4.9.8 Application for Payment ............................................................................ 96

4.9.9 Preparation of Housing Supplements .......................................................... 96

4.9.10 Updating of Housing Supplement ............................................................... 96

4.9.11 Multiple Occupancy of the Same Dwelling Unit ............................................. 97

4.9.12 Administrative Settlements ........................................................................ 97

4.10 Mortgage Costs/Incidental Expenses ......................................................................... 97

4.10.1 Application For Mortgage Interest and Incidental Expense Payment ................ 98

4.10.2 Incidental Expenses .................................................................................. 98

4.11 Replacement Housing Payments For Less Than 90-Day Occupants ................................ 99

4.11.1 Rental Assistance Payment ........................................................................ 99

4.11.2 Base Monthly Rental for Subject Dwelling .................................................... 99

4.12 Manner of Disbursement And Documentation Required ............................................. 100

4.13 Down Payment Assistance Payment ........................................................................ 101

4.14 Offer of Replacement Housing Supplement .............................................................. 101

4.15 Replacement Housing For Subsequent Occupants ..................................................... 101

4.16 General Requirements: Housing Supplements .......................................................... 102

4.16.1 Purchase of Replacement Dwelling............................................................ 102

4.16.2 Occupancy Requirements ........................................................................ 103

4.16.3 Conversion of Payment ........................................................................... 103

4.17 Payment After Death ............................................................................................ 103

4.18 Claims for Relocation Payments ............................................................................. 103

4.18.1 Time for Filing Relocation Claims .............................................................. 104

4.18.2 Deductions from Relocation Payments....................................................... 104

4.18.3 Notice of Denial of Claim ......................................................................... 104

4.19 Residential Moving Payments ................................................................................. 104

4.19.1 Residential Room Count Moving Payments ................................................. 105

4.19.2 Actual Moving and Related Expenses ........................................................ 105

4.19.3 Multiple Family Provisions........................................................................ 105

4.19.4 Costs of Transportation ........................................................................... 106

4.19.5 Moves of Personal Property Only (Dwelling Not Displaced) ........................... 106

4.20 Commercial, Farm & Non Profit Relocation ............................................................... 106

4.20.1 Overview............................................................................................... 106

4.20.2 Commercial Moving Payments .................................................................. 107

4.20.3 Ineligible Business Moving and Related Expenses ....................................... 109

4.20.4 Notification and Inspection ...................................................................... 110

4.20.5 Fixed Payment-Commercial Occupants ...................................................... 110

4.20.6 Farms-Fixed Payment ............................................................................. 110

4.20.7 Non Profit Organizations-Fixed Payment .................................................... 111

4.20.8 Average Annual Net Earnings - Business or Farm ....................................... 111

4.20.9 Processing Applications for In-Lieu Payment .............................................. 112

4.20.10 Competitive Moving Estimates (Commercial Moves) .................................... 112

4.20.11 Estimate Format .................................................................................... 112

4.20.12 Inventory of Personal Property ................................................................. 113

4.20.13 Tips on Performing an Inventory .............................................................. 113

4.20.14 Monitoring the Move ............................................................................... 114

4.20.15 Moving Payment Approval ....................................................................... 114

4.20.16 Self Moves ............................................................................................ 115

4.20.17 Expense Finding (Commercial or Residential Personal Property) ................... 115

4.20.18 Reestablishment Expenses And Related Eligible Expenses ............................ 116

4.20.18.1 Nonresidential Reestablishment Expenses ................................. 116

4.20.18.2 Ineligible Reestablishment Expenses ........................................ 116

4.21 Underground Storage Tanks on Acquired Property .................................................... 116

4.21.1 Decommissioning of Underground Tanks ................................................... 117

4.21.2 Decommissioning Process ........................................................................ 118

4.22 Advertising Signs ................................................................................................. 118

4.22.1 Policy .................................................................................................... 118

4.22.2 Sign Relocation Process .......................................................................... 119

4.23 Mobile Homes ...................................................................................................... 120

4.23.1 Moving Expenses .................................................................................... 120

4.23.2 Replacement Housing Payment - 90-Day Mobile Home Owner Occupant ........ 120

4.23.3 Replacement Housing Payments - 90-Day Mobile Home Tenant .................... 121

4.23.4 Replacement Housing Payment Based on Mobile Home and Site ................... 121

4.23.5 Comparable Replacement Dwelling ........................................................... 121

4.23.6 Mobile Home Relocation .......................................................................... 121

4.23.7 Partial Acquisition of a Mobile Home Park .................................................. 122

4.24 Last Resort Housing .............................................................................................. 122

4.25 Transient Occupants of NJDOT land ........................................................................ 122

4.26 Relocation Appeal Process ..................................................................................... 122

4.27 Leasing ............................................................................................................... 122

4.27.1 Establishment of Rental for Leases in Connection with “Active Projects” ........ 122

4.27.2 Rental to Public Agencies or Persons Not Displaced ..................................... 123

4.27.3 Protective Leasing .................................................................................. 123

4.27.4 Lease Agreements for hold over tenant ..................................................... 124

4.27.5 Starting Date of Rent .............................................................................. 124

4.27.6 Lease Approval Process in connection with “active projects”......................... 124

4.27.7 Receipt and Posting Rentals Collected ....................................................... 125

4.27.8 Rental Deposits and Mailing of Receipts of Payment Received ...................... 125

4.27.9 Delinquent Rentals ................................................................................. 126

4.27.10 Rental Eviction Policy .............................................................................. 126

4.27.11 Statutory Requirements for Property Leasing ............................................. 127

4.27.12 Maintenance of Leased Property ............................................................... 127

4.27.13 Management of Multiple Unit Leased Properties .......................................... 128

4.27.14 Registration of Leasehold Information ....................................................... 128

4.27.15 Real Estate Taxes and the Payment of the In Lieu of Municipal Services ........ 129

4.28 Taking Possession of Property ................................................................................ 131

4.28.1 Possession Certificate Distribution ............................................................ 131

4.28.2 Pre Construction and Transfer of Keys & Documents ................................... 131

4.28.3 Asbestos & Demolition for Properties that are Improved and Acquired ........... 131

4.28.4 Utility Removal for Acquired Buildings ....................................................... 133

4.29 Eviction Activities, ................................................................................................ 134

4.30 Retention of Realty by Owner ................................................................................ 135

4.31 Property Management ........................................................................................... 135

4.31.1 Inventory .............................................................................................. 137

4.31.2 Departmental Clearance of Excess Lands Process ....................................... 137

4.31.3 Surplus Property .................................................................................... 144

4.31.4 Excess Land .......................................................................................... 144

4.31.5 Excess Land File ..................................................................................... 144

4.31.6 Statutes and Regulations Related to Excess Land ....................................... 145

4.31.7 Public Auctions and Excess Land .............................................................. 148

4.31.8 Public Auction Process............................................................................. 150

4.31.9 Conduct of In Person Auction ................................................................... 150

4.31.10 Forfeiture of Deposits on Excess Land Contracts ......................................... 151

4.32 Handling of Cash .................................................................................................. 152

4.33 Property Leasing .................................................................................................. 152

4.33.1 Property Leasing Prior to Construction ...................................................... 154

4.33.2 Property Leasing After Construction .......................................................... 154

4.34 Public Auctions for Buildings and Excess Land .......................................................... 156

4.35 Encroachments .................................................................................................... 157

4.36 Functional Replacement of Real Property ................................................................. 157

4.37 Quality Control ..................................................................................................... 161

4.38 Processing of Relocation Payments ......................................................................... 162

Section 5 Title Closing ..................................................................... 164

5.1 General ............................................................................................................... 164

5.1.1 Introduction .......................................................................................... 164

5.1.2 Purpose ................................................................................................ 164

5.1.3 Requirements ........................................................................................ 164

5.1.4 Section Responsibilities ........................................................................... 164

5.1.5 Section Organization............................................................................... 165

5.2 Title Processing .................................................................................................... 165

5.2.1 Procedures ............................................................................................ 165

5.3 Field Searching .................................................................................................... 166

5.3.1 Requirements ........................................................................................ 166

5.3.2 Responsibility ........................................................................................ 166

5.3.3 Procedures ............................................................................................ 166

5.3.4 Minimum Search Requirements ................................................................ 167

5.3.5 Creating a Chain of Title .......................................................................... 167

5.3.6 Riparian Parcels ..................................................................................... 168

5.3.7 Plotting ................................................................................................. 168

5.3.8 Searching the Indices ............................................................................. 169

5.3.9 Searching for Liens ................................................................................. 169

5.3.10 Searcher’s Title Report ............................................................................ 170

5.3.11 Assemblage of the Chain of Title .............................................................. 170

5.3.12 Continuations ........................................................................................ 170

5.4 Title Examining .................................................................................................... 171

5.4.1 Requirements ........................................................................................ 171

5.4.2 Responsibility ........................................................................................ 171

5.4.3 Procedures ............................................................................................ 171

5.4.4 Reading a Title ....................................................................................... 171

5.4.5 Preparing the Report of Title .................................................................... 172

5.5 Condemnation ..................................................................................................... 174

5.5.1 Requirements ........................................................................................ 174

5.5.2 Responsibility ........................................................................................ 174

5.5.3 Procedures ............................................................................................ 174

5.5.4 Preparing the Title memorandum ............................................................. 175

5.5.5 Updating Title to Cover Lis Pendens – Declaration of Taking ......................... 175

5.5.6 Processing Awards and Judgments ........................................................... 176

5.5.7 Processing Awards or Judgments to be Paid Into Court ............................... 178

5.5.8 Award or Judgments that are the same as the Deposit Under a Declaration of

Taking 178

5.5.9 Case Closure ......................................................................................... 178

5.6 Agreement Processing and Settlements ................................................................... 179

5.6.1 Requirements ........................................................................................ 179

5.6.2 Responsibility ........................................................................................ 179

5.6.3 Incidental Closing Costs .......................................................................... 179

5.6.4 Procedures for Processing Agreement Cases .............................................. 179

5.6.5 Notice to Tax Assessor ............................................................................ 181

5.6.6 Preparing the Assembly Package for Final Review ....................................... 182

5.6.7 Agreements Providing For Exchange Of Excess Lands As Part Consideration ... 182

5.6.8 Down Payment Checks ............................................................................ 182

5.7 Settling Cases ...................................................................................................... 183

5.7.1 Requirements ........................................................................................ 183

5.7.2 Responsibility ........................................................................................ 183

5.7.3 Procedures ............................................................................................ 183

5.7.4 Invoicing/Check Process .......................................................................... 184

5.7.5 Follow-Ups and Cancellation of Checks ...................................................... 185

5.8 Local Aid Projects/Developer Agreements ................................................................ 186

5.8.1 Requirements ........................................................................................ 186

5.8.2 Responsibility ........................................................................................ 186

5.9 Title Company Liaison ........................................................................................... 186

5.9.1 Introduction .......................................................................................... 186

5.9.2 Requirements ........................................................................................ 187

5.9.3 Responsibility ........................................................................................ 187

5.9.4 Title Company Outsourcing Process .......................................................... 187

5.9.5 Procedures ............................................................................................ 190

5.9.6 Agreement Cases ................................................................................... 190

5.9.7 Notice to Tax Assessor ............................................................................ 190

5.9.8 Preparing the Certificate of Title ............................................................... 191

5.9.9 Check Coding Procedures and Settling Cases ............................................. 191

5.9.10 Agreements Providing for Exchange of Excess Lands as Part Consideration .... 192

5.9.11 Processing Awards or Judgments .............................................................. 192

5.9.12 Notice for Reimbursement of Incidental Costs ............................................ 192

5.9.13 Title Company Payments ......................................................................... 193

5.10 Records And Control ............................................................................................. 193

5.10.1 Requirements ........................................................................................ 193

5.10.2 Responsibility ........................................................................................ 193

5.10.3 Procedures ............................................................................................ 193

5.10.4 Database Entries .................................................................................... 193

5.10.5 Recording Instruments ............................................................................ 194

5.10.6 Notice to Tax Assessor ............................................................................ 195

5.10.7 Tax Search Requests .............................................................................. 195

5.10.8 Records of State Departments ................................................................. 195

5.10.9 Acquisition Log ...................................................................................... 195

5.10.10 Excess Parcel Conveyance Log ................................................................. 196

5.10.11 Filing Case Folders ................................................................................. 196

5.10.12 Active Files ............................................................................................ 196

5.10.13 Storage Files ......................................................................................... 196

5.10.14 Processing Cases for Storage ................................................................... 196

5.11 Reimbursement of Taxes ....................................................................................... 197

5.11.1 Requirements ........................................................................................ 197

5.11.2 Responsibility ........................................................................................ 197

5.11.3 Procedures for Tax Payments ................................................................... 197

5.11.4 Payment or Reimbursement for Incidental Closing Costs ............................. 199

5.12 Excess Land Sales ................................................................................................ 199

5.13 Dedications ......................................................................................................... 200

5.13.1 Responsibility ........................................................................................ 200

5.13.2 Procedures ............................................................................................ 200

5.14 Deed Notices ....................................................................................................... 201

Section 6 Right Of Way Administration ............................................ 202

6.1 General ............................................................................................................... 202

6.2 Preliminary Engineering Activities ........................................................................... 202

6.3 Right of Way Project Programming Process .............................................................. 202

6.3.1 Access Modification/Revocation ................................................................ 203

6.3.2 Right of Way Plans and Documents Package .............................................. 203

6.4 Phase Review ...................................................................................................... 203

6.5 Data Entry ........................................................................................................... 204

6.6 Project Funding .................................................................................................... 204

6.6.1 Funding ................................................................................................ 204

6.6.2 Authorization Process ............................................................................. 205

6.7 Transmittal of Project to District Office .................................................................... 205

6.7.1 Process ................................................................................................. 205

6.7.2 Content of Transmittal ............................................................................ 205

6.8 Final Right of Way Package Distribution................................................................... 205

6.9 Holds / Revisions / Eliminations ............................................................................. 206

6.9.1 Revisions to Parcel Design ....................................................................... 206

6.9.2 Distribution of Revised Plans / Agreement Forms ........................................ 206

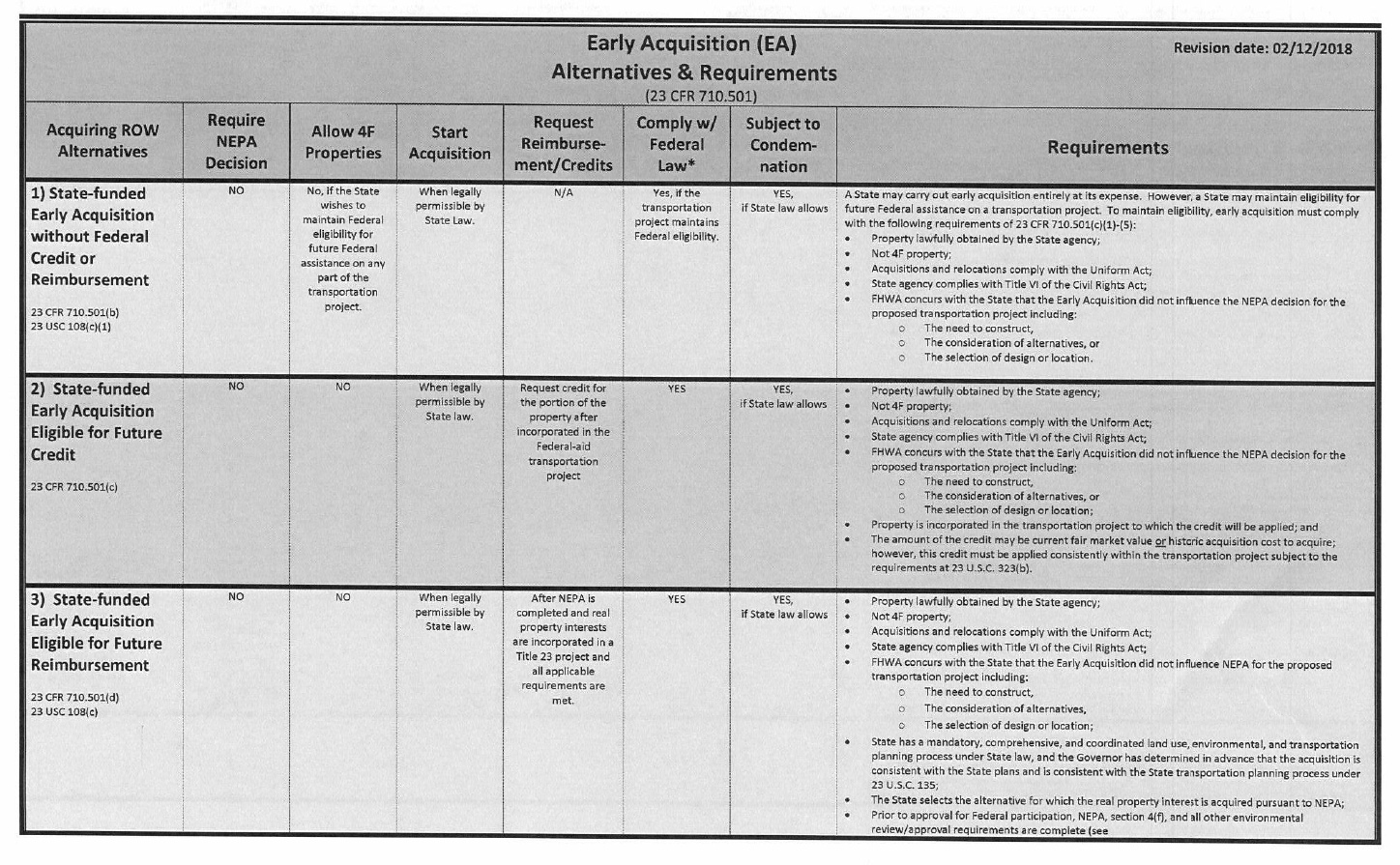

6.10 Advance Acquisition and Early Acquisition of Rights of Way ....................................... 206

6.10.1 Regulations ........................................................................................... 206

6.10.2 Advance Acquisition Process .................................................................... 207

6.10.3 Early Acquisition .................................................................................... 207

6.10.4 Early Acquisition Process ......................................................................... 208

6.11 Right of Way Statements, Certifications and Clearances ............................................ 208

6.12 Dedications/ Donations ......................................................................................... 209

6.13 Final Vouchering A Project ..................................................................................... 210

6.14 Suspense ............................................................................................................ 210

6.15 Administrative Functions ....................................................................................... 211

6.16 Local Public Agency Projects .................................................................................. 211

Section 7 Legal Processing .............................................................. 212

7.1 Organization/Purpose ........................................................................................... 212

7.2 Case Assignment .................................................................................................. 212

7.3 Tracking Progress And Status Of Cases Via The Right Of Way Database ...................... 213

7.4 Case Processing ................................................................................................... 213

7.4.1 Upon Receipt of a Case Assignment, the Research Analyst shall: .................. 213

7.4.2 Caption and Complaint Paragraphs 9 & 10 ................................................. 213

7.5 Pleadings ............................................................................................................ 213

7.5.1 Forms of Pleadings ................................................................................. 214

7.5.2 Filing Pleadings – The Process .................................................................. 216

7.6 Amendments ....................................................................................................... 217

7.6.1 Complaint ............................................................................................. 217

7.6.2 Declaration of Taking .............................................................................. 218

7.6.3 Additional Deposits ................................................................................. 218

7.6.4 Withdrawals .......................................................................................... 218

7.7 Service of Process ................................................................................................ 218

7.7.1 Types of Personal Service ........................................................................ 219

7.7.2 Substitute Service Methods ..................................................................... 220

7.7.3 Lead Time ............................................................................................. 220

7.7.4 Publication-Invoice ................................................................................. 220

7.8 Litigation Support ................................................................................................. 221

7.9 Conclusion of the Case .......................................................................................... 221

Section 8 Local Public Agency Guidance .......................................... 222

Addendum Section ............................................................................... 232

1

Section 1 Introduction

1.1 Purpose and Use

This Manual provides direction and guidance to personnel who carry out the New Jersey

Department of Transportation’s (Department) right of way acquisition program. Its

content is applicable to Department staff, right of way consultants and Local Public Agency

personnel who acquire right of way on NJDOT or FHWA funded projects.

The Manual addresses all major right of way functions including valuation, acquisition,

condemnation, relocation, property management. It also covers important Department

right of way administrative processes.

Local Public Agencies should be aware of the required elements in the acquisition process,

and apply them to each of the right of way acquisition functions that they undertake or

contract another entity to undertake on their behalf.

The provisions of this Manual comply with New Jersey and Federal statutes and

regulations. The Federal Highway Administration (FHWA) has reviewed and accepted the

Manual as meeting the requirement (23 CFR 710.201) that each State DOT maintain a

Manual that describes its policies and practices for all phases of the right of way program.

The Manual is an authoritative guide, which may reference other Department Manuals or

authorities and includes references to forms and other materials and guidance that can be

accessed electronically. Guidance documents may illustrate a typical procedure that does

not need to be part of the manual. The manual addresses all State and Federal

requirements for executing the right of way program. Staff and consultants who work

under its scope are required to comply with its provisions. However, the Department

recognizes that projects sometimes present situations that cannot be anticipated or

addressed in formal policy. Complex or unique cases involving acquisition, relocation or

other phases should be considered individually. Right of Way staff will inform the Project

Manager and other leadership officials about special situations as soon as they are

identified. This will enable prompt decisions to resolve issues. LPAs with issues may

contact the Right of Way & Access Management Division Technical Support Bureau.

The Director of the Right of Way & Access Management Division is authorized to interpret,

clarify or approve exceptions to provisions of the Manual. This may be done where

application of policy as written might be misunderstood or have an unintended effect when

applied to special situations. All interpretations, clarifications and exceptions must comply

with requirements of State or Federal laws or regulations, meet the intent of this Manual

and be fair to all parties.

1.2 Manual Revisions and Updates

This Manual will be updated as necessary to conform to changes in law, regulations and

Department organization as these events occur. It will also be revised to incorporate better

practices identified through Quality Control/Quality Assurance (QC/QA) activities. The

Department will certify to the FHWA every five years that the Manual conforms to existing

practices and that procedures comply with Federal and State laws and regulations.

Each person using the Manual has a responsibility to contribute to its improvement. Users

are invited to make suggestions, supported by an explanation of the reasoning for the

2

change, to the Director of the Right of Way & Access Management Division or to Right of

Way & Access Management Division Bureau managers or their immediate supervisor.

All substantive changes to any form, letter, other documents, process, procedure or formal

activities, must be submitted through the Manager, Technical Support Bureau. This

requirement includes any modifications to documents on the Intranet, PAECETrak

(database) system or the ROW Manual.

1.3 Authority and Oversight

1.3.1 Operating Authority

The NJDOT is authorized by N.J.S.A. 27:7-22 et seq. to acquire lands or rights therein by

gift, devise or purchase. It is also authorized to undertake condemnation in the manner

provided in the Eminent Domain Act of 1971 N.J.S.A. 20:3-1 et seq. The NJDOT is also

subject to the requirements set forth in the Federal Uniform Relocation Assistance and

Real Property Acquisition Policies Act of 1970 (URA), as amended [42 U.S.C. §4601 et

seq.] and the attendant regulations as set forth in 49 CFR 24. State law provides

authorization allowing NJDOT to utilize federal relocation standards to the extent that they

exceed state relocation [Relocation Assistance Law of 1967 (N.J.S.A. 52:31B-1 et seq.)

and the Relocation Assistance Act of 1971 (N.J.S.A. 20:4-1 et seq.) The NJDOT is

authorized under an FHWA Programmatic Waiver to use Administrative Determinations of

Value (ADV) (defined in federal regulations as a Waiver Valuation) where the estimated

compensation is $25,000 or less in order to set what it believes to be just compensation

as referenced in 49 CFR 24.2(a)(33) and 24.102(c)(2). Local public agencies using an

ADV are subject to a $10,000 upper limit of value.

The Department, and all public agencies are also bound by the 5th Amendment of the US

Constitution and by Article 1, Clause 20 of the New Jersey Constitution to provide payment

for property and interests in property that are acquired through eminent domain by them.

1.3.2 Oversight of the Right of Way Process

Whenever any FHWA funding is used in a project (even if not used for right of way

acquisitions) the FHWA exercises full oversight of the right of way acquisition process. The

level of oversight exercised by FHWA for any particular project or activity is defined in the

current FHWA / NJDOT Stewardship and Oversight Agreement. Both NJDOT and the Local

Public Agencies are required to use the federal relocation standards. In the event that a

New Jersey statute mandates a specific relocation benefit dollar amount, which exceeds

the federal amounts provided, the legislatively mandated state benefit will be substituted,

and to the extent approved by FHWA, it will be reimbursable by federal funding. It is the

responsibility of the Manager, Bureau of Technical Support to provide a yearly report to

the FHWA in accordance with Appendix B, 49 CFR Part 24. This report will be compiled

by the Technical Support Bureau and submitted to the FHWA as required.

Local Public Agencies utilizing this manual should make note of processes that would be

applicable to their acquisition process even though this manual may refer to a specific

Division unit doing that task. Common sense should be employed in recognizing the

necessary steps, even if the Local Public Agency is not specifically identified.

NJDOT entered into an agreement with FHWA to provide stewardship and oversight of the

right of way program. Stewardship includes the efficient and effective management of

public funds. Oversight includes complying with applicable State and Federal laws,

policies, and regulations.

3

As part of its stewardship obligations, NJDOT through the Division of Right of Way & Access

Management is responsible for oversight of the right of way acquisition process when FHWA

funds are provided to NJDOT or to Local Public Agencies and other state agencies through

NJDOT. This oversight is to ensure that the acquisition process (appraisals, negotiations,

condemnation and relocations) are carried out in accordance with the FHWA requirements

and federal and sate statutes and regulations that govern the use of such funds.

Federal participation in real property acquisition cost is limited to costs associated

with property incorporated into the final project and the direct costs associated with

real property acquisition required under the laws of New Jersey. See 1.5

The Division of Right of Way & Access Management is also responsible for oversight of the

right of way acquisition process undertaken by a Local Public Agency, which receives state

or federal funds provided by NJDOT. Details of the FHWA approved oversight process are

available in Section 6.16.

Where a Local Public Agency purchases land for a project using NJDOT or FHWA funds,

those lands in excess of the area needed for the right of way shall be conveyed to NJDOT

as a partial refund of the funding provided, unless otherwise provided.

1.3.3 Right of Way & Access Management Division’s Right of Way Functions

The Division of Right of Way and Access Management right of way functions are

decentralized, with a Northern and Southern District Office and a central Headquarters.

The District Offices are comprised of project teams, with each team being charged

with the responsibility for the completion of the appraisal/appraisal review,

negotiations and relocation functions for assigned projects as well as other project

planning activities.

The Headquarters’ office is comprised of the Office of the Director, and the Technical

Support and Closing Bureaus.

The Director’s office provides oversight and planning for the Division.

The Technical Support Bureau is responsible for project coordination through

PAECETrak, appraisal contracts, audit of district operations, quality control, property

management, oversight of relocation operations and provision of technical guidance

to district offices. It also is responsible for the programming/funding of right of way

projects including the final vouchering of closed projects.

The Closing Bureau is comprised of the Title Section, which is responsible for title

searches, agreement processing and closing of title. The Legal Processing Section

has responsibility for the preparation of the legal pleadings necessary to accomplish

the condemnation process.

Documentation produced by the Division’s activities is addressed mainly through the

PAECETrak system, which is intended to be a digital repository of the documents created

by the Division. For the purpose of determining which documents are to be uploaded into

the database system, the Districts, and Headquarters units are responsible to upload all

documents related to their activities that are completed within that unit and which involve

contact with the owner; spending of money; appraisals, appraisal reviews and NRE reports;

authorization of a decision by the Division, call data, letters and documents to and from

outside persons and entities, agreements, deeds and title research, and all other

documents or correspondence that are necessary for understanding the case. The

Technical Support Bureau will scan and input those documents from the Districts that are

4

approved by the Director after submission to HQ such as agreements and RE-27

documents and the Closing Bureau will upload copies of finalized deeds and legal case

materials generated by that Bureau.

Prior to a unit completing its work on a case such as a District submitting a case for

agreement or condemnation or final closing of the case by Closing, the supervisor of that

case in each unit performing work will verify and note in the PAECETrak database that all

required documents as noted above were uploaded into the PAECETrak database before

submission or closure of the case file.

1.3.4 Conflict of Interest

A. As set forth in the New Jersey Uniform Code of Ethics, “No State officer or employee or

special State officer or employee should have any interest, financial or otherwise, direct

or indirect, or engage in any business or transaction or professional activity, which is

in substantial conflict with the proper discharge of his/her duties in the public interest.”

“No special State officer or employee, nor any partnership, firm or corporation in which

he/she has an interest, nor any partner, officer or employee of any such partnership,

firm or corporation, shall represent, appear for, or negotiate on behalf of, or agree to

represent, appear for or negotiate on behalf of, any person or party other than the

State in connection with any cause, proceeding, application or other matter pending

before the particular office, bureau, board, council, commission, authority, agency, fund

or system in which such special State officer or employee holds office or employment.”

B. If an employee of the Department is the owner of property required for a project, it is

the policy of the Department to complete the appraisal and review of appraisal of the

property using only independent appraisal consultants. All property owner inquiries or

questions prior to registration of the property value shall be coordinated through the

Attorney General’s Office. When the property value is registered, the Department’s file

shall be transferred to the Attorney General’s Office. The Department's offer of

compensation for the required property shall be made through the Attorney General's

office and an acceptance of that offer or any subsequent questions that the owner may

have shall be made through the Attorney General's Office. It is also the policy of the

Department that after appraising the owner’s property and making its fair market value

offer to the owner, the Department will initiate condemnation to allow the

Commissioners, and if necessary the court, to establish the amount of just

compensation due that person, if the fair market value offer is not accepted by the

owner. The Attorney General’s Office will appoint two Deputy Attorneys General; one

to address any questions that the owner may have and one to present the case, if

necessary, before the Commissioners and/or Court.

C. It is the policy of the Department that no employee shall accept any gift or other thing

of value from any firm, organization, association or individual doing business with the

Department, or those that could reasonably be expected to do business with the

Department.

D. Every appraisal report, offer, counteroffer and settlement is a confidential matter

between the owner and the realty specialist (negotiator) and such information shall not

be shared with other owners on the project. This information is also not available

through the Open Public Records Act until after the Project is completed.

E. Under no circumstances will the same person that appraised, reviewed or prepared an

Administrative Determination of Value negotiate with the property owner.

5

1.3.5 Counsel

Legal counsel for the Division is available from the Division of Law, Transportation,

Condemnation and Contract Section, during the planning, design and bona fide

negotiations phases of the acquisition process, as well as during post complaint

settlement discussions. Project Realty Specialist 4s and their staff are strongly

encouraged to avail themselves of this resource. A Deputy Attorney General (DAG) or

the local agency’s attorney may be a useful resource for detecting complex valuation

pitfalls which can be avoided or minimized during the appraisal process and should be

called upon for advice on the law on benefits, before value/after value appraisals and

the compensability of particular items.

In complex cases, a DAG should be afforded the opportunity to participate in the realty

specialist’s pre complaint negotiations meetings with the owner or owner’s counsel and

to provide input into the decision to initiate the condemnation process. Questions

regarding changes in design are not an appropriate topic for legal advice.

A Local Public Agency (LPA) attempting project acquisitions and relocations is strongly

advised to consult with qualified legal counsel familiar with eminent domain issues. The

use of full service Right of Way Consultants may also be appropriate. The LPA may seek

assistance with technical questions through the Bureau of Technical Support.

1.4 Definitions

Access: Any rights the owner may or may not have to place or keep a driveway opening

onto a road at a specific location. Generally, access rights are a separate issue from

condemnation and regulation of driveways represent an administrative exercise of the

State’s police powers. Any questions regarding this issue need to be discussed promptly

to avoid incorrect conclusions and delays. For State highways and their associated

approaches, the Office of Access Design in the Division of Right of Way and Access

Management implements the Highway Access Management Act. Local Public Agencies may

have their own access process to address driveways on local roads.

Acquisition of Property: The Department may acquire property in a number of ways.

Except for donations and dedications, the other methods of property transfer are normally

bought under authority of the Eminent Domain statute. Unless otherwise specified, each

is subject to all acquisition and relocation requirements set forth in this manual.

1. Standard Acquisition: Property acquired during the normal course of a project after

environmental reviews are complete.

2. Early Acquisition: Consists of purchase of most or all needed right of way on a

project prior to environmental review being completed.

3. Advance Acquisition: Consists of purchases of a limited number of parcels for

hardship claims or protective buying on a proposed project prior to completion of

the environmental review.

4. Dedication: Land conveyed to NJDOT to fulfill a regulatory requirement for receiving

an Access Permit. This land is conveyed as part of a police power and not eminent

domain, and is not subject to 23 CFR 710.505.

5. Donation. Land donated to NJDOT as a voluntary act by an owner. Where a

donation is part of a project, it is subject to 23 CFR 710.505, Where the donation

is a voluntary transfer at the request of an owner and NOT part of any active project

the donation is not subject to that regulation.

6

Administrative Determination of Value (ADV): The term Administrative

Determination of Value is NJDOT equivalent of the FHWA term “waiver valuation” and

refers to the valuation process used and the product produced when the Agency

determines that an appraisal is not required, pursuant to § 24.102(c)(2).

Appraisal: A written statement independently and impartially prepared by a qualified

appraiser setting forth an opinion of defined value of an adequately described property as

of a specific date, supported by the presentation and analysis of relevant market

information.

Bona Fide Negotiations: The process of conducting negotiations to acquire the rights

or property needed in a manner that is fair to both sides. New Jersey’s Eminent Domain

Act of 1971 requires bona fide negotiations to include a written offer delivered to the owner

of the property to be acquired, which sets forth the property and/or interest to be acquired,

the compensation offered to be paid, and provision of the appraisals, which were used to

establish the offer of compensation.

Business: Any lawful activity, except a farm operation, that is conducted (a) primarily

for the purchase, sale, lease and/or rental of personal and/or real property, and/or for the

manufacture, processing and/or marketing of products, commodities and/or any other

personal property; or (b) primarily for the sale of services to the public; or (c) primarily

for outdoor advertising display purposes, when the display must be moved as a result of

the project; or (d) by a nonprofit organization that has established its nonprofit status

under applicable Federal or State law.

Compensable Damages: Those damages to the property for which the owner may be

entitled to compensation. See Sec. 2.5.5. for additional discussion of compensability of

damages. Specific questions regarding compensability should be addressed to the

Technical Support Bureau.

Comparable Replacement Dwelling: A dwelling that is determined to be a suitable

replacement for the displaced person’s former residence, meeting local code and FHWA

requirements. For details, see Sec. 4.3.3.

Decent, Safe and Sanitary Dwelling: A dwelling that meets applicable housing and

occupancy codes, along with the standards set forth by the FHWA.

Displaced Person: Any person who moves from the real property or moves her/his

personal property from the real property as a direct result of a written notice of intent to

acquire, the initiation of negotiations for, or the acquisition of, such real property, in whole

or in part, for a project. This includes a person who occupies the real property prior to its

acquisition, but who does not meet the length of occupancy requirements of the Uniform

Act.

Division: Unless otherwise indicated, the use of the term Division shall refer to the

Division of Right of Way & Access Management, and more particularly to the right of way

functions of the Division.

Donation: Means the voluntary transfer of privately owned real property, by a property

owner who has been informed in writing by the acquiring agency of rights and benefits

available to owners under the Uniform Act and this section, for the benefit of a public

transportation project without compensation or with compensation at less than fair market

value. Source: § 710.105 Definitions. The Commissioner has the authority to accept

donations under Title 27.

7

Dwelling: The place of permanent or customary and usual residence of a person,

according to local custom or law, including a single family house; a single family unit in a

two-family, multi-family, or multi-purpose property; a unit of a condominium or

cooperative housing project; a non-housekeeping unit; a mobile home; or any other

residential unit.

Easement: An easement is an interest that allows a person or entity the right to occupy

or use, the real property of another person or entity, but does not convey ownership.

Eminent Domain: The inherent power of the state or federal government to acquire

property for a public use. This power is exercised through condemnation. The eminent

domain authority of all New Jersey public agencies is limited by the federal and state

constitutions, court decisions and in New Jersey by the Eminent Domain Act of 1971

N.J.S.A. 20:3-1 et seq. Local Public Agencies may also be subject to other statutory

limitations. When it is not possible to conclude an agreement as a result of bona fide

negotiations, the state or Local Public Agency (“LPA”), where authorized by law, may

institute condemnation proceedings to acquire the property and provide a judicial

determination of just compensation. Although federal funds may be involved in the

project, the acquisition and condemnation authority is based on New Jersey law and

conducted in New Jersey courts. Neither the Department, nor any other New Jersey public

agencies can utilize private property without payment unless the owner waives its right to

compensation. This also applies to contractors working on behalf of the Department or an

LPA.

Encroachment: Using the lands of another property owner or the right of way without

consent. An encroachment can be permanent such as a building or paving or an

intermittent use such as parking cars. (see also Illegal Parking Spaces).

Fair Market Value: "Fair market value" for eminent domain purposes has been defined

by the New Jersey courts as "the value that would be assigned to the acquired property by

knowledgeable parties freely negotiating for its sale under normal market conditions based

on all surrounding circumstances at the time of the taking." State v. Silver, 92 N.J. 507,

513-14 (1983).

In 2003, the New Jersey Supreme Court cited a 2000 Appellate Division decision, in which

"fair market value" was defined as what a willing buyer and a willing seller would agree to

as of the date of the taking, neither being under any compulsion to act. Hous. Auth. of

New Brunswick v. Suydam Investors, 17 N.J. 2 (2003); County of Monmouth v. Hilton, 334

N.J. Super. 582, 587 (App Div. 2000), certif, denied, 167 N.J. 633 (2001).

The Court in Hilton also said that the inquiry [into Fair Market Value] should not be limited

to the actual use of the property on the date of taking but rather based on its highest and

best use.

Farm Operation: Any activity conducted solely or primarily for the production of one or

more agricultural products or commodities, including timber, for sale or home use and

customarily producing such products or commodities in sufficient quantity to be capable of

contributing materially to the operator's support.

Highest and Best Use: That use of the property which is "1) legally permissible, 2)

physically possible, 3) financially feasible, and 4) maximally productive. Hous. Auth. of

New Brunswick v. Suydam Investors, 23 N.J. 2 (2003) Citing County of Monmouth v.

Hilton, 334 N.J. Super. 582, 587 (App Div. 2000), cert. denied, 167 N.J. 633 (2001). See

Sec. 2.5.4.

8

Incidental Expenses: Reimbursable expenses include, but are not limited to recording

fees, transfer taxes, costs for prepayment of any preexisting recorded mortgage and a pro

rata share of prepaid property taxes. Attorney fees may qualify for reimbursement only

where those services are directly related to the transfer of title.

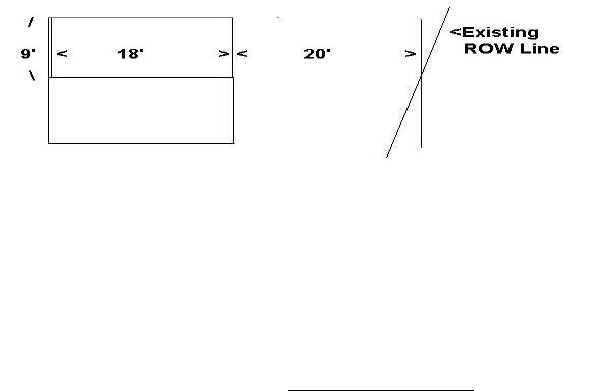

Illegal Parking Space: Parking lot space that is physically located in or uses part of the

right of way. Example: Top parking stall has sufficient (20’) clearance to maneuver. Lower

stall maneuvering room crosses part of the diagonal right of way line making it illegal.

Initiation of Negotiations: The delivery of the initial written offer of just compensation,

by the Department to the owner or the owner's representative for the purchase of real

property. For the purpose of relocations, the date of initiation of negotiations for a

relocatee who moves prior to the date of the offer but after the initial notification is the

date of the move. See: 49 CFR 24.2(a)(15)(i) though (iv).

Inspection of Property: Outside of the condemnation authority, the Department may

also conduct limited inspections of property that it plans to acquire through New Jersey

statutory authority under N.J.S.A. 20:3-16.

Just Compensation for a Tenant: Valuation based upon the amount, which the

improvement contributes to the fair market value of the whole property, or its salvage

value, whichever is greater. No payment shall be made directly to a tenant-owner for any

real property improvement unless: (1) the tenant-owner, in consideration for the payment,

assigns, transfers and releases to the Department all of the tenant-owner’s right, title and

interest in the improvement; (2) the owner of the real property on which the improvement

is located disclaims all interest in the improvement; and (3) the payment does not result

in the duplication of any compensation otherwise authorized by law.

Last Resort Housing: Federal law specifies limits for residential relocation payments. In

certain instances, those limits may be exceeded as set forth in this manual including for

such reasons as hardship, or income criteria. Last Resort Housing is any amount above

those limits necessary to meet relocation requirements under federal or state regulations

or laws. In the event that last resort housing is invoked, the file must be documented as

to the specific reason for the use of Last Resort Housing. A memo setting forth the

circumstances is sufficient.

Linear Construction Guidance: Remediation standards authorized by the New Jersey

Department of Environmental Protection for work in a linear corridor such as a road or

utility right of way corridor that may be different from or less than standards that a typical

property owner may be subject to.

Local Public Agencies (LPAs): Counties, municipalities and government agencies,

including other State Departments which received funding from the Department and which

must therefore adhere to the procedures, rules and regulations set forth herein in

undertaking the acquisition of property or interests in property.

9

Mobile Home: Dwellings such as manufactured homes and recreational vehicles used as

residences. Refer to 49 CFR Part 24, Appendix A, § 24.2(a)(17) for additional guidance

pertaining to the use of mobile homes for replacement housing.

Negotiated Purchase: A purchase made without resorting to eminent domain. The

basic tenant of the acquisition process is to make every reasonable effort to expeditiously

acquire real property through bona fide negotiations.