HOMEBUYER GUIDE

11. NUMBERS REVIEW

10. CLEAR TO CLOSE

6. PROCESSING

8. UNDERWRITING APPROVAL

3. FINDING YOUR HOME

4. INSPECTION

5. LOAN APPLICATION

9. CLOSING PACKAGE

7. APPRAISAL

12. CLOSING DAY

1. INITIAL CONSULTATION

2. PRE-APPROVAL

Whether you’re a new or seasoned homebuyer, often we need

reminders on how the process works. Let’s get you that new set of keys!

Updated: 03/20/2019

NMLS ID #1041 (www.nmlsconsumeraccess.org); CA – Licensed by the Department of Business Oversight under the California Residential

Mortgage Lending Act; MN – This is not an offer to enter into an agreement. Any such offer may only be made in accordance with the

requirements of MN. Stat. Section 47.206 (3) and (4); NJ – Licensed by the N.J. Department of Banking and Insurance; WA – CL-1041

1. INITIAL CONSULTATION

We’ll outline your buying potential.

We will inquire about your income, assets, liabilities and credit so we can assess

your current debt-to-income ratio and determine a qualifying payment or

purchase price. At this time we will also be asking you questions to determine

your needs and goals for the home purchase.

Debt-to-income ratio: This is a key ratio used to determine the amount of money you can

borrow. It’s your monthly payment obligation divided by your gross monthly income.

2. GETTING PRE-APPROVED

Provide all requested documentation (a list of typical

documentation follows on page 3 of this guide).

Pre-approval is not required to start home shopping, but we highly suggest

getting approval beforehand so you can shop in confidence. In a competitive

buying environment, pre-approvals can often times have the upper hand in

multiple offer situations. Summit Mortgage also offers a $10,000 underwriting

guarantee* to approved buyers which can make your offer stand out

against others. Pre-approval is based on your provided documentation. This

documentation provides information such as your credit score, PITI, PMI, escrow

payment, and loan types.

$10,000 underwriting guarantee: *For qualifying borrowers, if your loan doesn’t close, we’ll pay

the seller $10,000 out of our own pocket. Some limitations may apply.

Credit score: Your credit score is a major factor in determining if you’ll be approved for a home

loan. It will also impact the interest rate you qualify for. There are three major credit bureaus:

Equifax, Experian, and TransUnion. Data from your credit score is categorized into five major

elements that make up your credit score: payment history, amounts owed, length of credit

history, new credit, and types of credit used.

PITI: An acronym for the total mortgage payment, which is made up of Principal, Interest, Real

Estate Taxes, and Insurance.

PMI (Private Mortgage Insurance): Insurance provided by a private company to protect the

mortgage lender against losses that might be incurred if a loan defaults.

Escrow payment: An amount paid along with monthly mortgage payment for items such as

taxes or homeowners insurance.

Loan types: There are many types of mortgages available. Your Summit Mortgage loan officer

will help you understand your options so that you can make an informed decision. Use the table

on the next page as a guide.

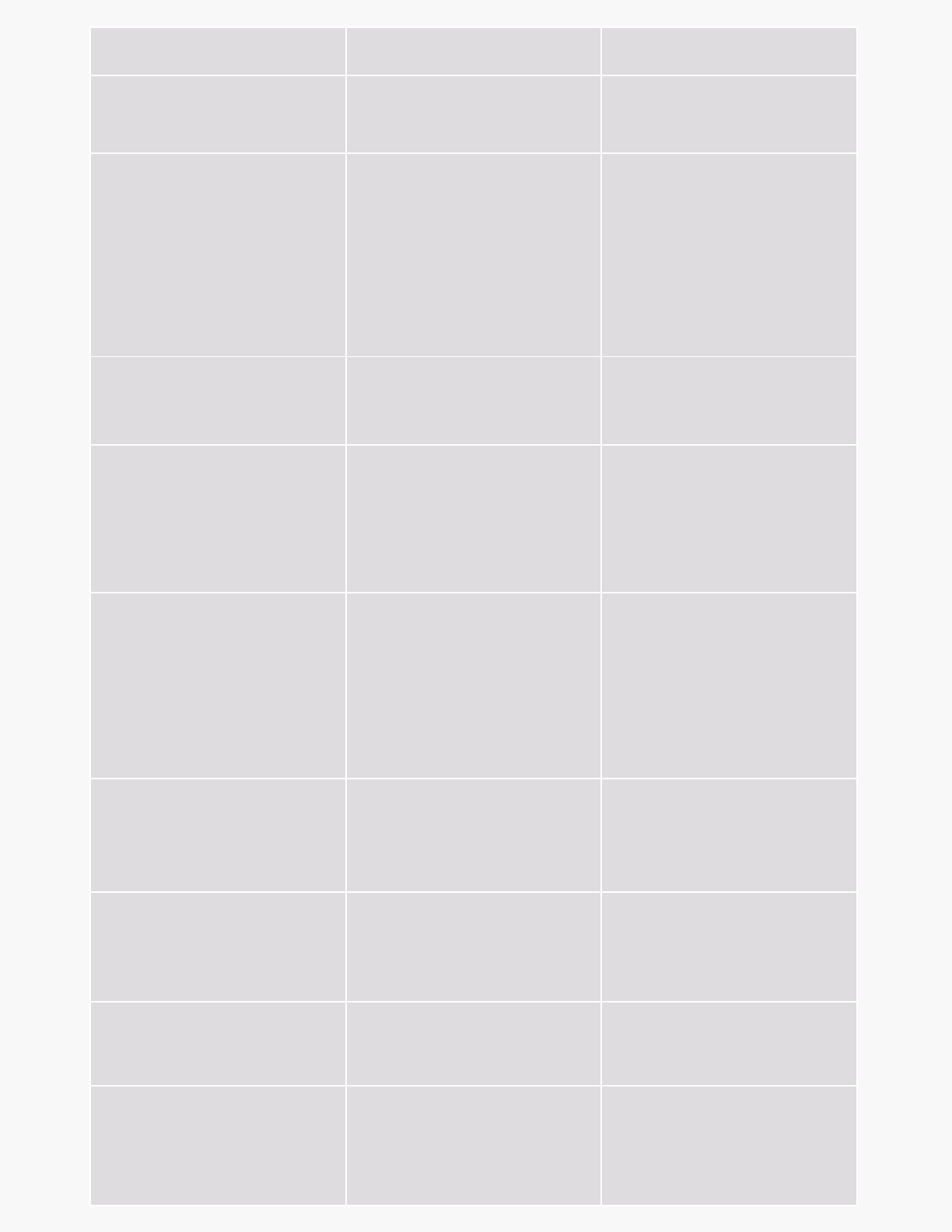

LOAN TYPE FEATURES WHO MAY BENEFIT

Fixed-rate mortgage

·Predictable monthly payments.

·Rate will remain the same over

the entire term.

Buyers who plan to live in the

home for a long period of time or

want predictable payment.

Adjustable-Rate Mortgage

(ARM): The rate may go up

or down on pre-determined

dates reflecting current market

conditions.

·The initial interest rate is

generally lower than that of a

fixed rate.

·The initial interest rate is locked

in for a fixed period of time.

·There are different introductory

periods of time to choose from

(e.g. 5-year, 7-year, 10-year).

·After the introductory period,

the rate can adjust every year.

Buyers that would like to have

a lower monthly payment

compared to a fixed-rate

mortgage.

FHA Loan: The Federal Housing

Administration designed these

loans to meet the needs of low or

moderate incomes.

·Low, 3.5% minimum down

payment required.

·Flexible qualifying guidelines.

Buyers looking to make a lower

down payment or have limited

funds for a down payment.

VA Loans: The Department of

Veterans Affairs guarantees loans

for qualified veterans.

·100% financing on qualified

transactions.

·Gift funds can be used for all or

a portion of the down payment

and closing costs.

·No mortgage insurance required.

Active-duty service members

and veterans and surviving

spouses who have not remarried.

USDA Loans: Guaranteed by the

US Department of Agriculture.

·Low or no down payment.

·Flexible qualifying guidelines.

·Property must be located in

qualifying rural area.

·Maximum income based on

geographic area.

Buyers who live outside

metropolitan areas and are

looking to make a lower down

payment.

Conventional Loans: Fannie Mae

and Freddie Mac conforming &

non-conforming loans.

·Low down payment with

mortgage insurance on

conforming loan limits.

·No MI with 20% down.

Buyers with more money to put

down and lower debt-to-income

ratios.

HomeReady(R) & Home

Possible(R)

·Low down payment

·Lower mortgage insurance than

traditional conventional loans.

·At least one borrower must

complete homebuyer education.

Buyers with low or moderate

monthly income or have limited

funds for a down payment.

HomePath: Fannie Mae Real

Estate Owned (REO) properties.

·Low down payment

·No mortgage insurance

·No appraisal.

Investors who want to purchase a

pool of foreclosed properties with

the intent to renovate and rent

the properties.

Down Payment Assistance

Programs: funded by private

and public partnerships,

organizations either state, county

or city sponsored, non-profit

entities, etc.

·Low down payment first

mortgages or stand alone 2nd

mortgages.

·Income limitations.

Buyers who need help covering

down payment and/or closing

costs.

DOCUMENT CHECKLIST

Purchase Property Information

The address of the property being purchased, if you have it, along with the purchase price

Estimates of annual property taxes, homeowner’s insurance and homeowner association dues (if any).

A purchase contract signed by all parties (Purchase Loan).

Homeowners insurance information, including the agent’s name and phone number

Additional Assets: This is how you’ll demonstrate to lenders that you’ll be able to fund

your down payment and any closing costs.

Bank account balances including retirement accounts.

Gift donor information (if applicable).

Settlement statement (if using funds from the sale of a property).

Sale of assets documentation (proof of ownership, proof of sale, proof of funds transferred/deposited).

Mortgage Statements for all properties owned.

Income and Identity Information: This is how you’ll demonstrate to lenders that you

are who you say you are and that you receive a regular income and will be able to

afford the monthly mortgage payments.

ALL HOMEBUYERS MUST PROVIDE:

Full legal name, social security number and date of birth.

Current driver’s license or other government-issued photo ID.

Residence history for the past two years, phone number and email address.

Employment history for the past two years.

A written explanation if you have been employed less than two years or if employment gaps exist.

Primary and secondary sources of income.

Bank account balances including retirement accounts.

Source of funds documentation for any large deposits on bank statements.

Divorce Decree/Marital Settlement Agreement (if applicable).

W2 EMPLOYED APPLICANTS MUST PROVIDE:

W-2 statements from the last two years.

Pay stubs fore the past 30 days.

Federal tax returns (1040s) for the past two years, all pages.

SELFEMPLOYED APPLICANTS MUST PROVIDE CORPORATION OR PARTNERSHIPS:

Business tax returns for the past two years, all pages, including K1 statements.

A year-to-date profit and loss statement and balance sheet

Payment History: This is how you’ll demonstrate to lenders that you manage your

finances responsibly and make your debt payments on time.

Monthly debt obligations

Bankruptcy discharge paperwork for bankruptcies in your credit history.

3. FIND YOUR HOME, MAKE AN OFFER, SIGN THE

PURCHASE AGREEMENT

Ask your real estate agent about earnest money and seller-paid

closing costs.

Purchase agreement: This is the document received after mutual acceptance on an offer,

which states the final sale price and all terms of the purchase. The specific items in this

contract vary by state.

Earnest money: Buyer pays this to the seller before closing to ensure the buyer’s seriousness

about purchasing the home. This money is not an additional cost and will be credited towards

the purchase price at closing.

Seller-paid closing costs: Closing costs associated with your loan that are paid by the seller’s

proceeds to reduce out-of-pocket expenses for you.

4. HOME INSPECTION

You have the choice to order a home inspection at this time. Your

real estate agent will assist with ordering this and will let you know

the upfront cost of the inspection.

Home inspection: Your home inspection should be performed by an inspector who will educate

you and provide details on the home’s condition for existing and potential problems. While

home inspections are not mandatory, they are highly recommended so that you are aware of

problems before you decide to buy a property. These problems could result in offering a lower

purchase price, or moving on and finding a home that is better suited for you.

5. MORTGAGE LOAN APPLICATION

You’ve been pre-approved for a loan. You’ve found a home that

meets your needs, and you’ve made an offer to buy it. The seller

has accepted your offer.

Your loan officer will let you know what you will need to complete our loan

application. This is a straightforward step in the process, but necessary to

complete and send your status into the processing stage.

6. INITIAL PROCESSING

Once you have a purchase agreement and a completed loan

application, your file will move into the processing stage. This is

another important step in the loan approval process.

Loan processors collect a variety of documents from you, as well as the property

being purchased. They will review the file to ensure it contains all of the

documents needed for the underwriting process (step 7 below).

Consult with your loan officer about locking in your interest rate and sign your

initial disclosures. Also at this time, you will be asked to obtain homeowners

insurance.

Locking in your interest rate: A rate lock is a guarantee from a mortgage lender that they will

give you a certain interest rate, at a certain price, for a specific time period.

Homeowners insurance: An insurance policy that combines various protections for your new

home. Let your insurance agent know coverage will need to meet 100% of the insurable value

of the property.

7. HOME APPRAISAL

Once your offer is accepted, an appraisal will be ordered for your

new home.

Home appraisal: An appraisal provides valuable information for the buyer, but the appraiser’s

primary mission is to protect the lender. Lenders can’t lend more money than the property is

worth and that’s why the appraisal takes place before the lender grants final approval of the

buyer’s loan. The appraiser surveys the physical condition of the home and runs a comparative

analysis of similar homes recently sold. A copy of the appraisal report is always provided to the

buyer.

8. FILE IS SUBMITTED TO UNDERWRITING FOR APPROVAL

Keep in mind the underwriter may request a few additional items

for review prior to issuing the final approval.

At this stage, it is very normal to get additional requests to submit information.

If you have been requested to submit additional documents, be sure to get

everything back within 24 hours so there are no delays with your closing.

Underwriting: The process a lender uses to determine the risk of offering a mortgage loan

to a borrower. During this process the underwriter uses industry guidelines to analyze the

various aspects of the mortgage and provide recommendations regarding the risks involved.

Ultimately, it’s the underwriter who makes the final decision on whether to approve or decline

a loan.

9. CLOSING DISCLOSURE (CD) SIGNED AND CLOSING

PACKAGE SENT TO THE TITLE COMPANY

When you receive the CD, sign it as soon as possible so there are

no delays with your closing.

This is a form that gives you finalized details about your mortgage loan. It

includes the loan terms, your projected monthly payments, and the amount you

will need to pay in fees and other closing costs.

Title company: The title company verifies ownership of the property and determines the valid

owner through a thorough examination of property records in a title search. The title search

determines the legal owner of the property; reveals any mortgages, lien judgments, or unpaid

taxes outstanding on the property; and details any existing restrictions, easements, or leases

that affect the property. The title search ensures you’ll be the legal owner of the property and

we, as your lender, will be in first lien position.

10. YOU’VE HAVE REACHED A HUGE MILESTONE!

You’re so close to owning a home. Please be sure to stay in touch

with your loan officer about any last minute financial decisions.

11. FINAL NUMBERS REVIEWED

A few days prior to closing, we’ll contact you with the final

numbers.

You’ll have specific instructions on whether to obtain a cashier’s check and who

it should be made out to, or if a wire is needed for funds to close.

You’ll need to obtain this at least one day prior to closing. Each title company has

different requirements as to whether they will accept a cashier’s check or if you

need to have a wire transfer.

12. CLOSING DAY

Congratulations, it’s time to get your new keys!

Don’t forget your drivers license, your checkbook, and your funds for closing.

You’ll sign all of the final disclosures; note and mortgage. We’ll be there with your

closing agent to answer any questions. Once the documents are signed, the keys

will be yours!