NEW HOME BUYER Guide

Use this helpful guide to educate yourself on the homebuying

process and learn very useful tips to make the process easy!

????

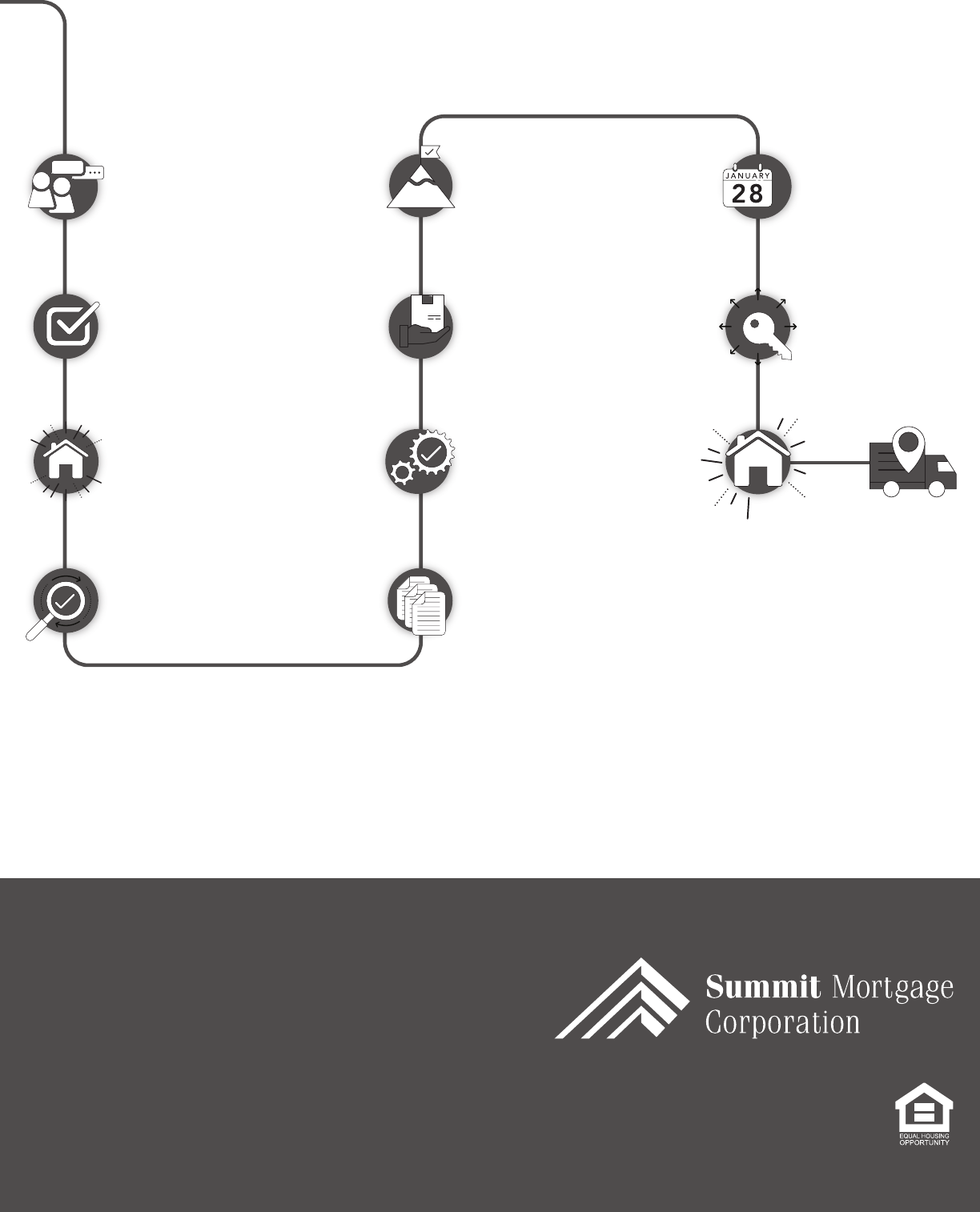

1. INITIAL

CONSULTATION

2. PRE-APPROVAL

3. FINDING

YOUR HOME

4. APPRAISAL

6. UNDERWRITING

APPROVAL

7. CLOSING

PACKAGE

8. CLEAR

TO CLOSE

9. NUMBERS

REVIEW

10. CLOSING

DAY!

NMLS# 1041. This is not an offer to enter into an agreement. Any such

offer may only be made in accordance with the requirements of MN.

Stat. Section 47.206 (3) and (4)”

5. PROCESSING

SOLD

PRO TIP: Ask your Realtor

®

about getting an Inspection!

????

INITIAL CONSULTATION

Your current financial situation is discussed

We will inquire about your income, assets, liabilities and credit so we can assess your

current debt-to-income ratio and determining a qualifying payment or purchase price.

GETTING PRE-APPROVED

Provide all requested documentation (a list of typical documentation

follows on page 3 of this guide).

Pre-approval is needed for you to start shopping for the home that fits your needs.

We will discuss specifics with you including your credit score, PITI including PMI,

escrow payment and the best loan type.

DEBT-TO-INCOME RATIO: This is a key ratio used to determine the amount of money you can borrow. It is your monthly

payment obligation divided by your gross monthly income.

CREDIT SCORE: Your credit score could mean the difference between being denied or approved for a

home loan, and how low or a high of an interest rate. There are 3 major credit bureaus: Equifax,

Experian, and Transunion. Data from your credit score is categorized into 5 major elements that make

up your credit score: payment history, amounts owed, length of credit history, new credit and types of

credit used. For example even if you have paid your outstanding credit on time but every account you

have is used to the maximum amount, your scores will be lower than someone who has high maximum

credit but lower balances on each.

PITI: An acronym for the total mortgage payment, which is made up of Principal, Interest, real estate

Taxes and Insurance.

PMI (PRIVATE MORTGAGE INSURANCE): Insurance provided by a private company to protect the

mortgage lender against losses that might be incurred if a loan defaults.

ESCROW PAYMENT: An amount paid with monthly mortgage payment for items such as taxes or

homeowners insurance.

PAGE 1

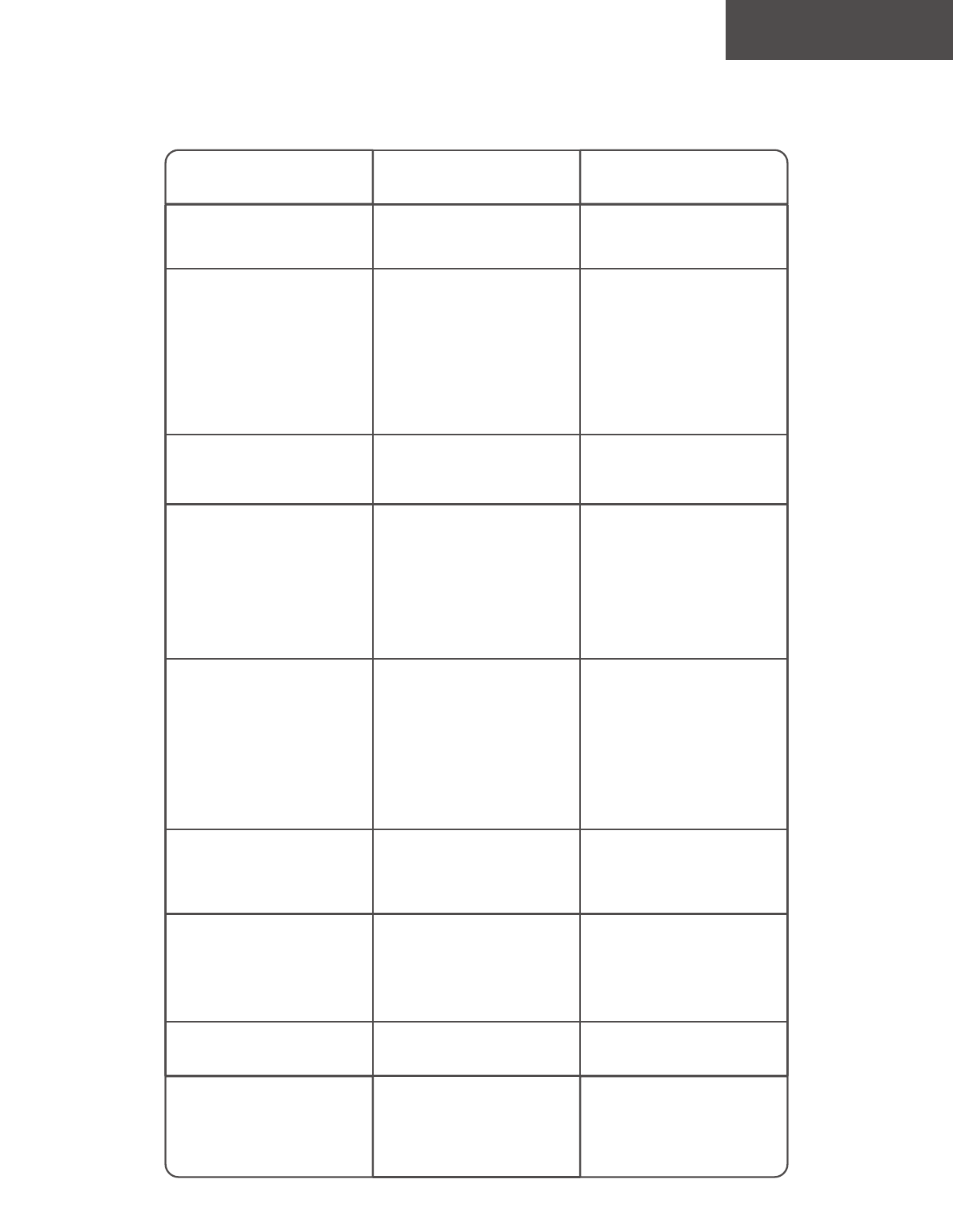

LOAN TYPE: There are many types of mortgages available. Your Summit Loan Officer will help you understand

your options so that you can make an informed decision. Use this table as a guide:

LOAN TYPE

FIXED RATE MORTGAGE - the

interest rate stays the same for

the life of the loan

ADJUSTABLE RATE MORTGAGE

(ARM) - the rate may go up or

down on pre-determined dates

reflecting current market

conditions

FHA LOAN - The Federal Housing

Administration designed these

loans to meet the needs of low or

moderate incomes

VA LOANS

- The Department of

Veterans Affairs guarantees loans

for qualified veterans

USDA LOANS

- Guaranteed by

the US Department of Agriculture

CONVENTIONAL LOANS -

Fannie Mae, Freddie Mac

Conforming & Non Conforming

HOMEREADY &

HOMEPOSSIBLE

HOMEPATH - Fannie Mae REO

properties

DOWN PAYMENT ASSISTANCE

PROGRAMS - funded by private

and public partnerships,

organizations either state, county

or city sponsored, non-profit

entities, etc.

FEATURES

Predictable monthly payments

Rate will remain the same over

the entire term.

The initial interest rate is generally

lower than that of a fixed rate.

The initial interest rate is locked in

for a fixed period of time.

There are different introductory

periods of time to choose from

ex. 5yr, 7yr, 10yr

After the introductory period the

rate can adjust every year.

Low 3.5% minimum down

payment required.

Flexible qualifying guidelines.

Gift funds can be used for all or a

portion of the down payment and

closing costs.

Low or no down payment.

Flexible qualifying guidelines.

Property must be located in

qualifying rural area.

Maximum income based on

geographic area.

There is an upfront Mortgage

Insurance fee and a monthly MI

fee.

Low down payment with

mortgage insurance on

conforming loan limits.

No MI with 20% down.

More strict qualifying guidelines.

Low down payment, lower

mortgage insurance than

traditional conventional loans.

At least one borrower must

complete home buyer education.

Low down payment, no mortgage

insurance, no appraisal.

Low down payment first

mortgages or stand alone 2nd

mortgages.

Income limitations.

WHO MAY BENEFIT

This type of loan is chosen when a

buyer plans to remain in the home

for a long period of time.

This type of loan is chosen by a

buyer who plans to refinance or

sell the home in a few years or can

make a larger monthly payment if

the rate adjusted upwards.

For example: maybe a spouse is

in school and will be getting a job

in a year or two, promotion, etc.

This type of loan is often chosen

by a buyer looking to put less

money down.

Available to active-duty or veteran

military service members.

Un-remarried surviving spouses of

a veteran who died from

service-connected injuries or

un-remarried surviving spouse of

a veteran who was totally disabled

at the time of death may also

qualify.

This type of loan is often chosen

by a buyer looking to put less

money down.

This type of loan is often chosen

by a buyer with more money to

put down and lower debt to

income ratios.

This type of loan is often chosen

by a buyer with lower to moderate

income.

This type of loan is often chosen

by a buyer wanting to purchase an

REO (Real Estate Owned) property.

This type of loan is often chosen

by a buyer needing assistance

with down payment and closing

costs.

PAGE 2

PAGE 3

REQUESTED DOCUMENTS LIST

YOUR SOURCE OF INCOME - HOW YOU’LL PAY YOUR MORTGAGE

EVERYONE

□ Federal Tax Returns (All pages)

□ Child support/alimony (if using income to qualify): court order or 12 months cancelled checks or bank

statements showing consistent deposits

□ Award letters for social security, pension, disability, etc.

W-2 WAGE EARNERS

□ Pay stubs for the last 30 days (if your income includes overtime, bonuses or differential pay, you may

need your most recent end-of-year payroll stub)

□ W2’s for the last 2 years

□ Written explanation if employed less than 2 years or a 30 day gap in the last 2 years.

SELF-EMPLOYED

□ Self-employed documentation

□ Year to date profit and loss

□ Year to date balance sheet

□ List of all business debts

□ Evidence business pays debts

YOUR ASSETS - HOW YOU’LL FUND YOUR DOWN PAYMENT

□ Original bank statements for last 2 months (checking, savings, and investment accounts)

□ Original account statements for last 2 months (stocks and investments)

□ Settlement statement (if using funds from the sale of a property)

□ Sale of assets (proof of ownership, proof of sale, proof of funds transferred to you)

YOUR PAYMENT HISTORY - TO REVEAL YOUR BORROWING PRACTICES

□ Cancelled rent or mortgage checks for the last 12 months, if not available on credit report

□ Bankruptcy discharge paperwork

□ Proof of paid off collections/judgments

ADDITIONAL INFORMATION - IF APPLICABLE

□ Purchase agreement including legal property description and any addendum

□ Discrepancies on credit including explanation of discrepancies

MISCELLANEOUS - IF APPLICABLE

□ _______________________________________________________________________

□ _______________________________________________________________________

□ _______________________________________________________________________

The detailed list above is only partial. As mortgage industry technology improves, more lenders will be

able to obtain many of the documents above from their sources (with your authorization) rather than

getting paper, emails, or uploads from you.

Improved technology may help with convenience, but it won’t reduce the documentation needed, so this

list provides the proper perspective of what goes into a loan approval.

FIND YOUR HOME, MAKE AN OFFER, SIGN THE

PURCHASE AGREEMENT

Your Realtor

®

will ask you about earnest money and seller paid

closing costs.

You will also be asked if you would like to order a home inspection. Your Realtor

®

will assist

with ordering this and will let you know the upfront cost of the inspection.

PURCHASE AGREEMENT: This is the document received after mutual acceptance on an offer, which states the

final sale price and all terms of the purchase. The specific items in this contract vary by state.

EARNEST MONEY: Buyer pays this to the seller before closing to ensure the buyer’s seriousness about

purchasing the home. This money is not an additional cost and will be deducted from the purchase price at

closing.

SELLER PAID CLOSING COSTS: Closing costs associated with your loan that are paid by the seller’s proceeds

to reduce out-of-pocket expenses for you.

HOME INSPECTION: Your home inspection should be performed by an inspector that educates the buyer

about the condition of the home and its major components. Obtaining a home inspection will provide details on

the home's condition with an eye toward both existing and potential future problems.

Once your offer is accepted your new home will need to be

appraised by a qualified appraiser.

The home appraisal is a key component to your home buying transaction.

HOME APPRAISAL

APPRAISAL: An appraisal provides valuable information for the buyer, but the appraiser's primary mission is to protect

the lender. Lenders can’t lend more money than the property is worth and that's why the appraisal takes place before the

lender grants final approval of the buyer's loan. The appraiser surveys the physical condition of the home and runs a

comparative analysis of similar homes recently sold. A copy of the appraisal report is always provided to the buyer.

PAGE 4

Keep in mind the underwriter may request a few additional items for

review prior to issuing the final approval.

This is a normal part of the process, so don’t let this worry you. If you have been requested

to submit additional documents, be sure to get everything back within 24 hours so there

are no delays with your closing.

Once your offer is accepted we will also begin finalizing your

documentation and requesting updated documents including bank

statements, pay stubs and proof of your earnest money clearing

your account.

At this time you will also obtain homeowners insurance, consult with your loan officer

regarding locking in your interest rate and sign your initial disclosures.

Your file will be prepped for Underwriting.

INITIAL PROCESSING

FILE IS SUBMITTED TO UNDERWRITING FOR APPROVAL

UNDERWRITING: The process a lender uses to determine the risk of offering a mortgage loan to a particular borrower.

Most of the risks and terms that underwriters consider fall under the three C’s of underwriting: credit, capacity and

collateral. During this process the underwriter uses industry guidelines to analyze the various aspects of the mortgage

and provide recommendations regarding the risks involved. Ultimately, it is always up to the underwriter to make the final

decision on whether to approve or decline a loan.

PAGE 5

HOMEOWNERS INSURANCE: An insurance policy that combines various personal insurance protections, which can

include losses occurring to one's home, its contents, loss of use (additional living expenses), or loss of other personal

possessions of the homeowner, as well as liability insurance for accidents that may happen at the home or at the hands of

the homeowner within the policy territory. Let your insurance agent know coverage will need to meet 100% of the

insurable value of the property.

LOCKING IN YOUR INTEREST RATE: A rate lock is a guarantee from a mortgage lender that they will give you a certain

interest rate, at a certain price, for a specific time period.

A rate lock protects you from rising interest rates: If you lock in a rate of 4.75 percent, you only have to pay 4.75 percent

interest even if rates rise while you’re going through the loan application process. Usually, a rate lock is good for 30, 45 or

60 days, though that time period can be shorter or longer; once that period expires, you may be subject to

lock-extension fees.

You are so close to owning a home! Please be sure to stay in touch

with your loan officer about any last minute financial decisions.

A few days prior to closing, we will contact you with the final

numbers.

You will have specific instructions on whether to obtain a cashier’s check, who it should be

written out to or if a wire is needed for funds to close.

You will need to obtain this at least 1 day prior to closing. (Each title company has

different requirements as to whether they will accept a cashier’s check or if you need to

have a wire transfer.)

FINAL NUMBERS REVIEWED

Congratulations, it’s time to get your new keys!

Don’t forget your drivers license, your checkbook and your funds for closing.

You will sign all of the final disclosures; note and mortgage. We will be there with your title

agent to answer any questions. Once the documents are signed, the keys will be yours!

CLOSING DAY

YOU HAVE REACHED A HUGE MILESTONE!

The CD is sent to you, remember to sign this ASAP so there are no

delays with your closing.

This will go over the amount of money that is needed for closing and your

monthly payment.

CLOSING DISCLOSURE/CD SIGNED AND

CLOSING PACKAGE SENT TO THE TITLE COMPANY

TITLE COMPANY: The title company verifies ownership of the property and determines the valid owner through a

thorough examination of property records in a title search. The title search determines the legal owner of the property;

reveal any mortgages, liens judgments or unpaid taxes outstanding on the property and details any existing restrictions,

easements or leases that affect the property. The title search ensures you will be the legal owner of the property and we,

as your lender, will be in first lien position.

10

PAGE 6

PREPARING FOR YOUR MORTGAGE APPROVAL

Do’s and Don’ts before and during the loan process

GOOD HABITS: THE DO’S

DO: Keep paying your bills on time including any mortgage, car, credit cards, etc. even if

they’re being paid through the new loan.

DO: Inform us in advance of any employment or income change.

DO: Keep copies of all pay check stubs you receive.

DO: Call us before changing your marital status.

DO: Call us if you are going out of town or planning a vacation.

DO: Call us anytime if you are unclear or have a question about your loan.

POTENTIALLY HARMFUL: THE DON’TS

DON’T: Change your employment status or your pay scale, even if it seems good. This

could endanger your loan approval. Call us first.

DON’T: Buy new furniture for your home or anything where your credit report needs to be

pulled, including interest free credit at a furniture store. Hint: If they need your SSN,

they’re probably going to check your credit. Call us first.

DON’T: Start significant home improvements on your home.

DON’T: Payoff collections or charge-offs. From now on, don’t pay off collections unless we

specifically ask you to. Generally, paying off old collections causes a drop in the

credit score.

DON’T: Max out or over charge existing credit cards.

DON’T: Consolidate debt. Wait until after your loan closes.

DON’T: Close credit card accounts.

DON’T: Cosign on a loan, change your name, or address.

DON’T: Make large purchases such as real estate or vehicles.

DON’T: Move money around, open, or close accounts. Keep funds in one account.

DON’T: Make cash or unexplainable deposits into bank accounts.

NMLS# 1041. This is not an offer to enter into an agreement. Any such

offer may only be made in accordance with the requirements of MN.

Stat. Section 47.206 (3) and (4)”