Private Mortgage

Insurance Handbook

September 2021

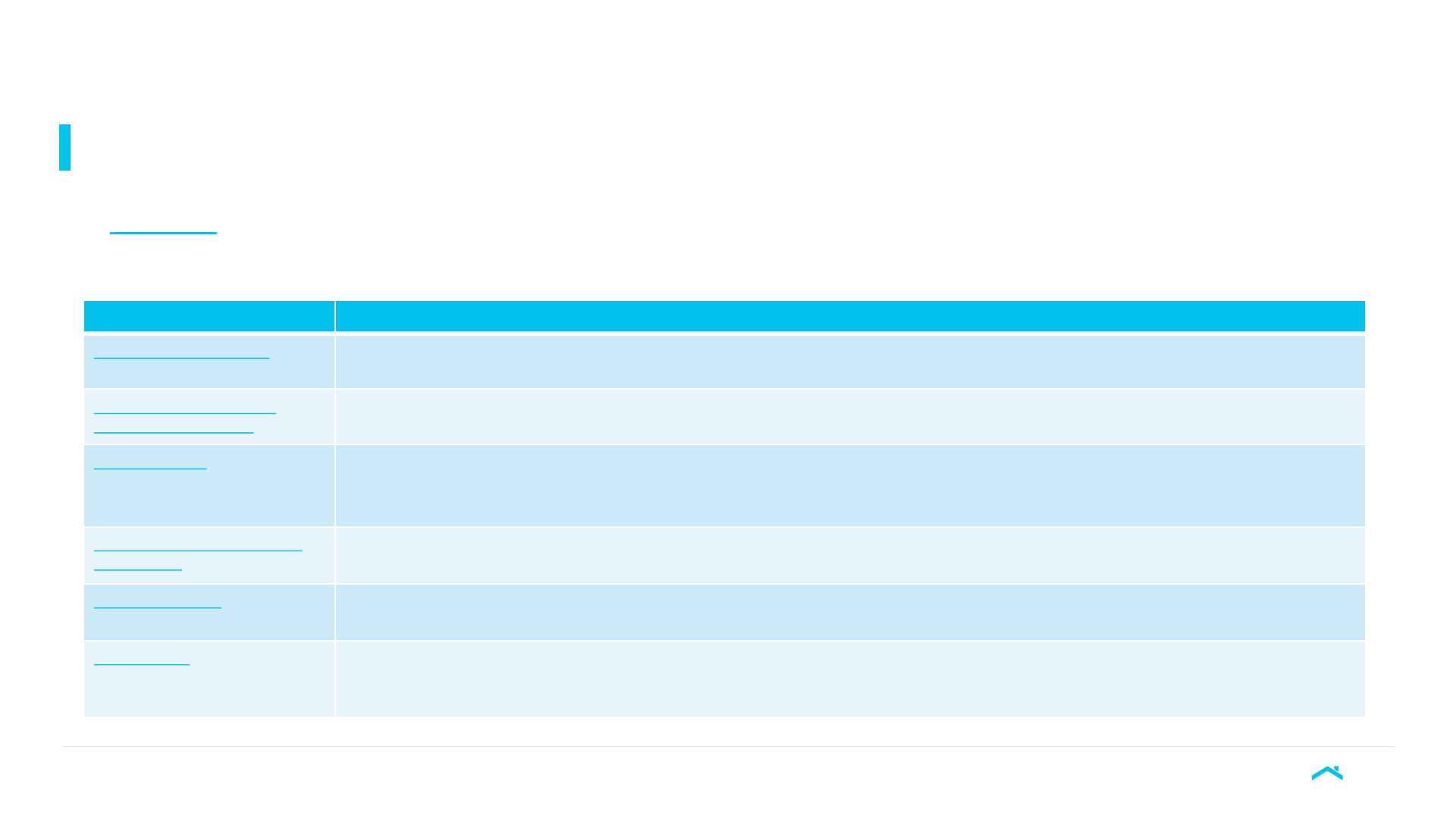

Index

1. Introduction to Private Mortgage Insurance

2. PMI Industry Counterparties

3. Private Mortgage Insurer Eligibility Requirements

4. Master Policy and Claims

5. Disclaimer

3-10

11-12

13-14

15-16

17-18

Introduction to Private

Mortgage Insurance

Private Mortgage Insurance Handbook

Freddie Mac | 2021

What is Private Mortgage Insurance (PMI)?

Introduction to Private Mortgage Insurance

▪ Freddie Mac’s Charter* requires credit enhancement for any loans greater than 80% LTV. PMI is the most

commonly used form of credit enhancement.

▪ PMI is a guaranty tied to the mortgage payment performance of a borrower and provides coverage in the event

that borrowers default on their mortgage obligations leading to a claim event such as a foreclosure sale, deed in

lieu or third-party sale.

▪ PMI is provided by privately-owned mortgage insurers that are separate from the insurance or guarantees

provided on government-backed loans insured or guaranteed by FHA or VA.

▪ Supporting homeownership:

▪ While mortgage insurance (MI) is an added insurance policy for homeowners that put down less than 20% of the

purchase value, it enables borrowers to buy now and begin building equity versus waiting to build enough savings for a

20% down payment.

▪ Freddie Mac is able to purchase low-down-payment mortgages because the mortgage insurance helps protect

against losses from a credit default.

4

*12 U.S.C. Section 1454(a)(2)

Freddie Mac | 2021

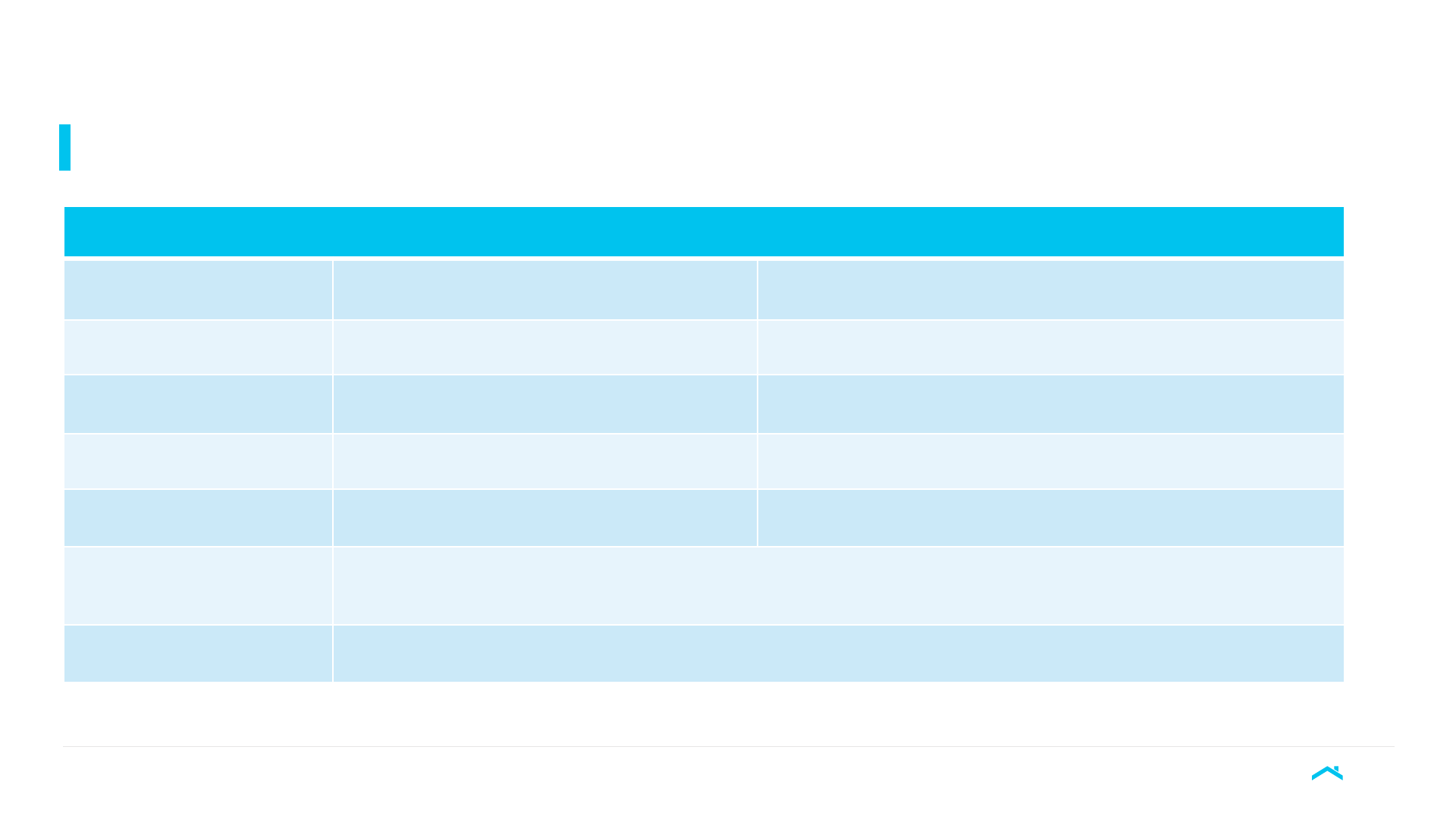

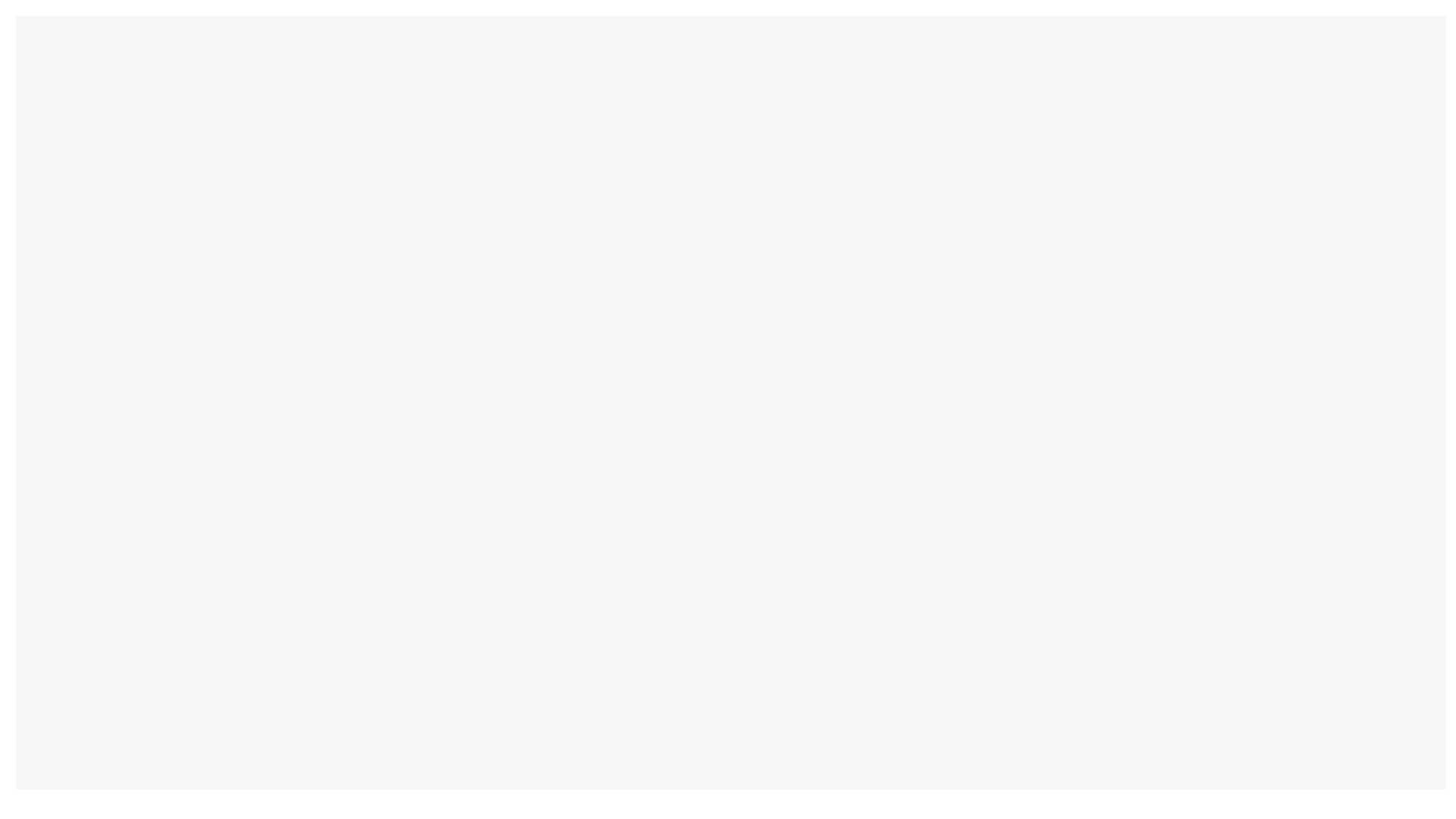

Standard Freddie Mac MI Coverage Requirements

5

Standard Loan to Value (LTV) and MI Coverage

LTV Ratios

Fixed Rate Term ≤ 20 Years Fixed Rate Term > 20 Years, ARMs and MH

>80% ≤ 85% 6% 12%

>85% ≤ 90%

12% 25%

>90% ≤ 95%

25% 30%

>95% ≤ 97%*

35% 35%

Property Types

1

-4 unit Primary Residence, 1-4 unit Investment Property, 1-unit Second Home

Transaction Type

Purchase, No cash

-out refinance, Cash-out refinance

Introduction to Private Mortgage Insurance

*Home Possible Mortgages >95% ≤ 97% MI Coverage is capped at 25%

Freddie Mac | 2021

6

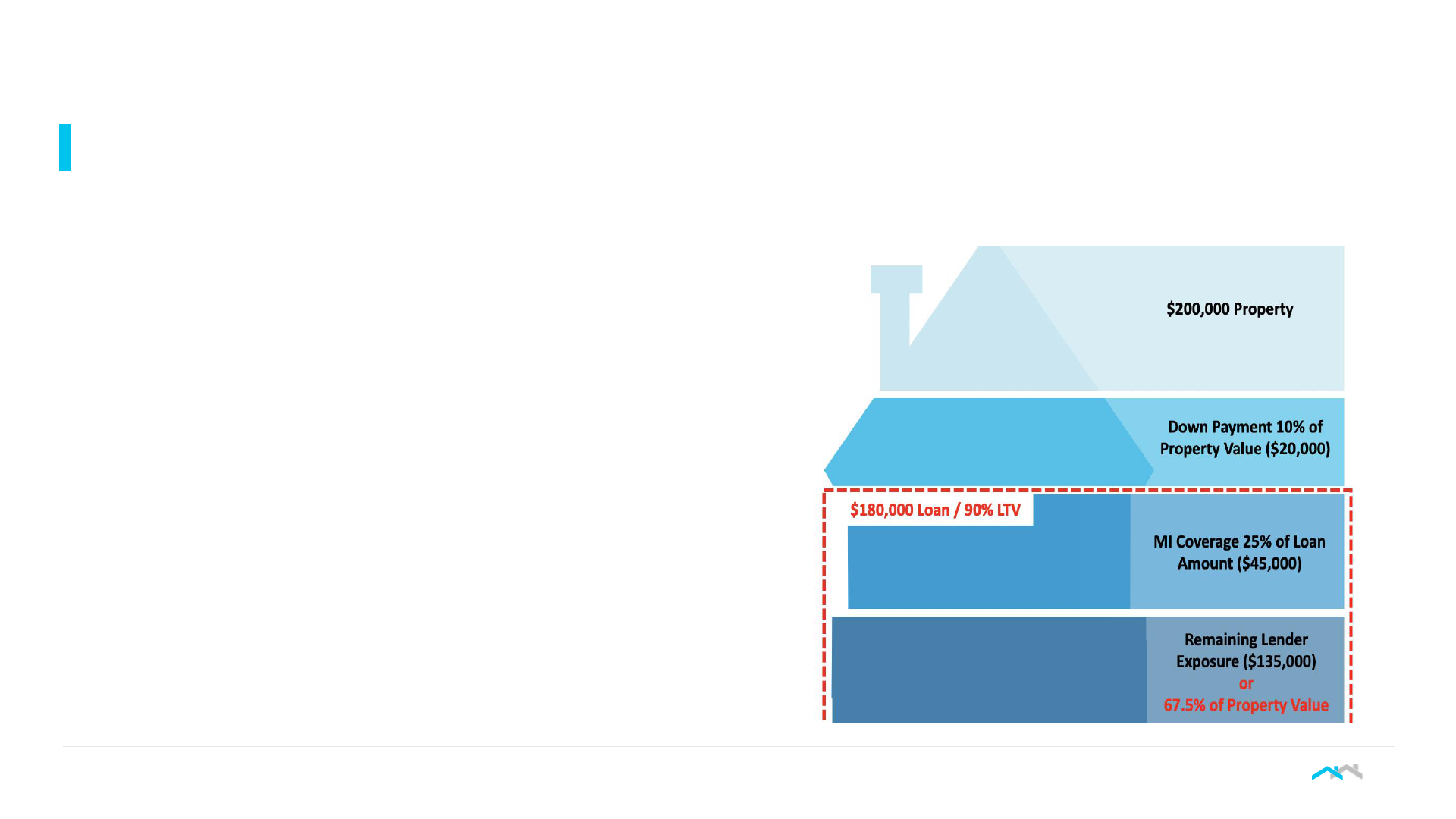

MI Reduces Freddie Mac’s Loss Exposure

Example: Percentage Option

▪ Freddie Mac requires 25% MI coverage on a fixed-rate

mortgage with 90% loan-to-value (LTV).

▪ In the event of a claim, the MI Company is responsible for

paying 25% of the outstanding balance plus claimable

expenses, reducing the ultimate loss exposure to the

lender or investor to 67.5% of the original property value.

Introduction to Private Mortgage Insurance

Freddie Mac | 2021

MI Claim Amount Calculation Example

*

7

Introduction to Private Mortgage Insurance

Freddie Mac

Claim Amount Components

Total Amount

A Defaulted UPB

$200,000

B Eligible Expenses

$20,000

C Accrued Interest

$6,000

D = A+B+C Claim Amount

$226,000

*Stylized example with specific details found in the master policies

Freddie Mac | 2021

MI Payment of Insurance Benefit Options and Example

Introduction to Private Mortgage Insurance

Options Calculation Notes

Percentage Option

Claim Amount multiplied by the MI Coverage Percentage ▪ Most commonly used

Third Party Sale

Option

The lesser of (i) the Claim Amount less Net Proceeds of

such Third-Party Sale and ii) Percentage Option

▪ Applicable only if the MI approves a Third-Party Sale within the Claim

Settlement Period

Acquisition Option 100% x Claim Amount

▪ For any claim the MI may, at its option, exercise its right to acquire the

property in settlement of the claim. The MI is most likely to exercise this

option in strong housing markets when the MI believes it can sell the

property at a price that would reduce its loss relative to what it would pay

under the Percentage Option or Third-Party Sale Option.

Payment of Insurance Benefit Options Examples

Claim Amount

$226,000

Options MI Payout

Percentage Option: (25% MI Coverage) = Claim Amount x 25%

$56,500

Third Party Sale Option: (Net Proceeds $200,000)

Lesser of Claim Amount - Net Proceeds ($226,000-$200,000) or Percentage Option ($56,500)

$26,000

Acquisition Option: Claim Amount

$226,000

8

Freddie Mac | 2021

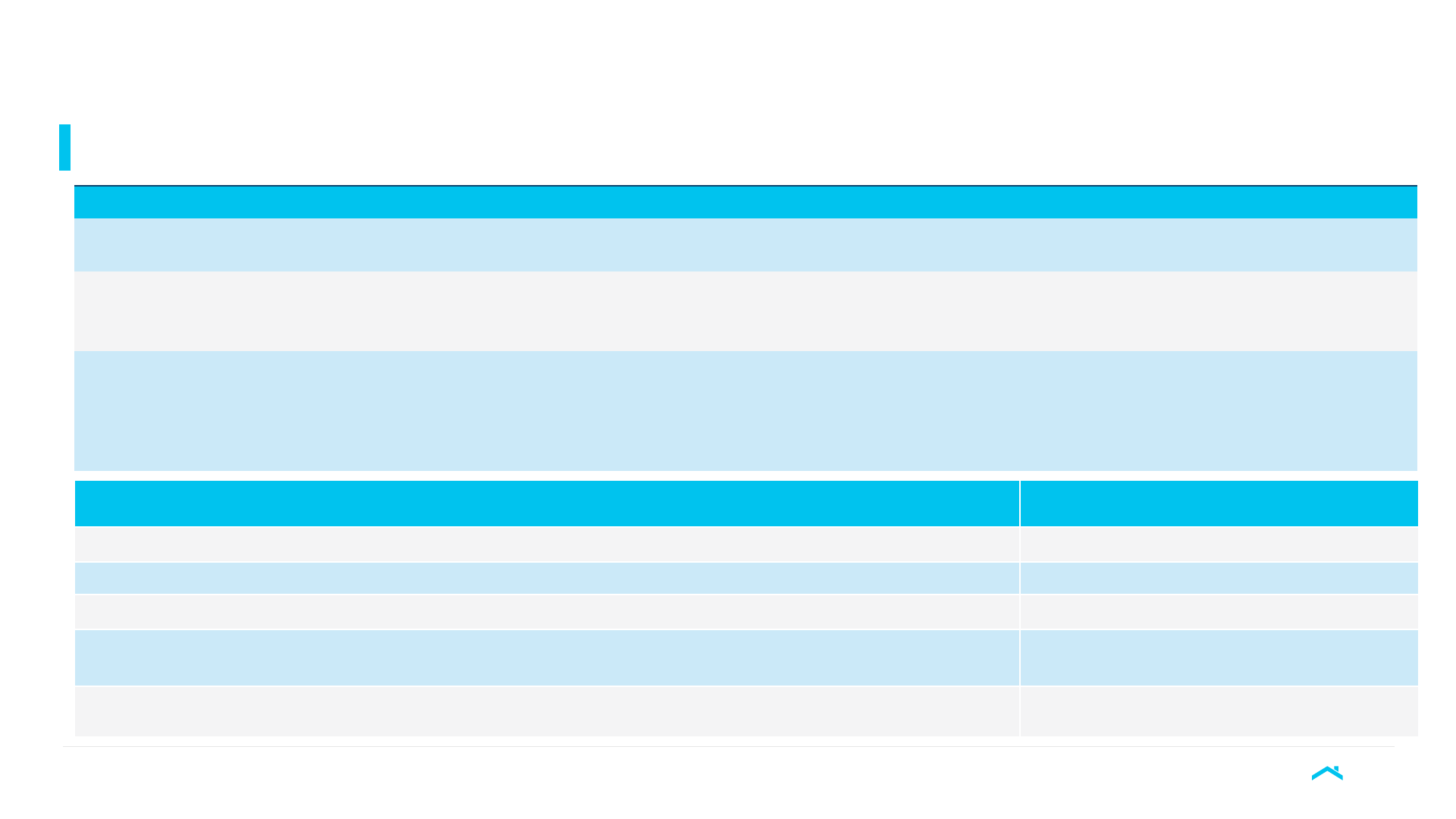

How Borrowers Pay for MI

9

*90% of New Insurance Written today uses borrower-paid Monthly Premiums with the remaining 10% consisting of BPMI & LPMI Single Premiums. Annual and Split Premiums are rarely used

by lenders in the current environment.

Monthly Premiums

Annual Premiums

Single Premiums

Split Premiums

Borrower Paid

MI (BPMI)*

▪

Paid on monthly basis

as part of principal,

interest, taxes and

insurance (PITI)

payments, usually as

part of the borrower’s

escrow payments

▪ An annual premium is

paid in advance, with

annual renewal

premiums paid

thereafter

▪

Borrowers pay a one-time,

single payment up front at

closing or finance it into the

loan amount

▪

Split Premiums give

borrowers the option of

paying part of the MI

premium up front in order to

reduce the monthly MI

premium paid along with their

mortgage payment.

Lender Paid MI

(LPMI)

▪

Lender pays a one-time single premium payment upfront

▪

Lender-paid premiums are usually built into the mortgage interest rate payment through a higher note rate or the

origination fee.

▪

Lender-paid single premiums are not cancellable

Introduction to Private Mortgage Insurance

Freddie Mac | 2021

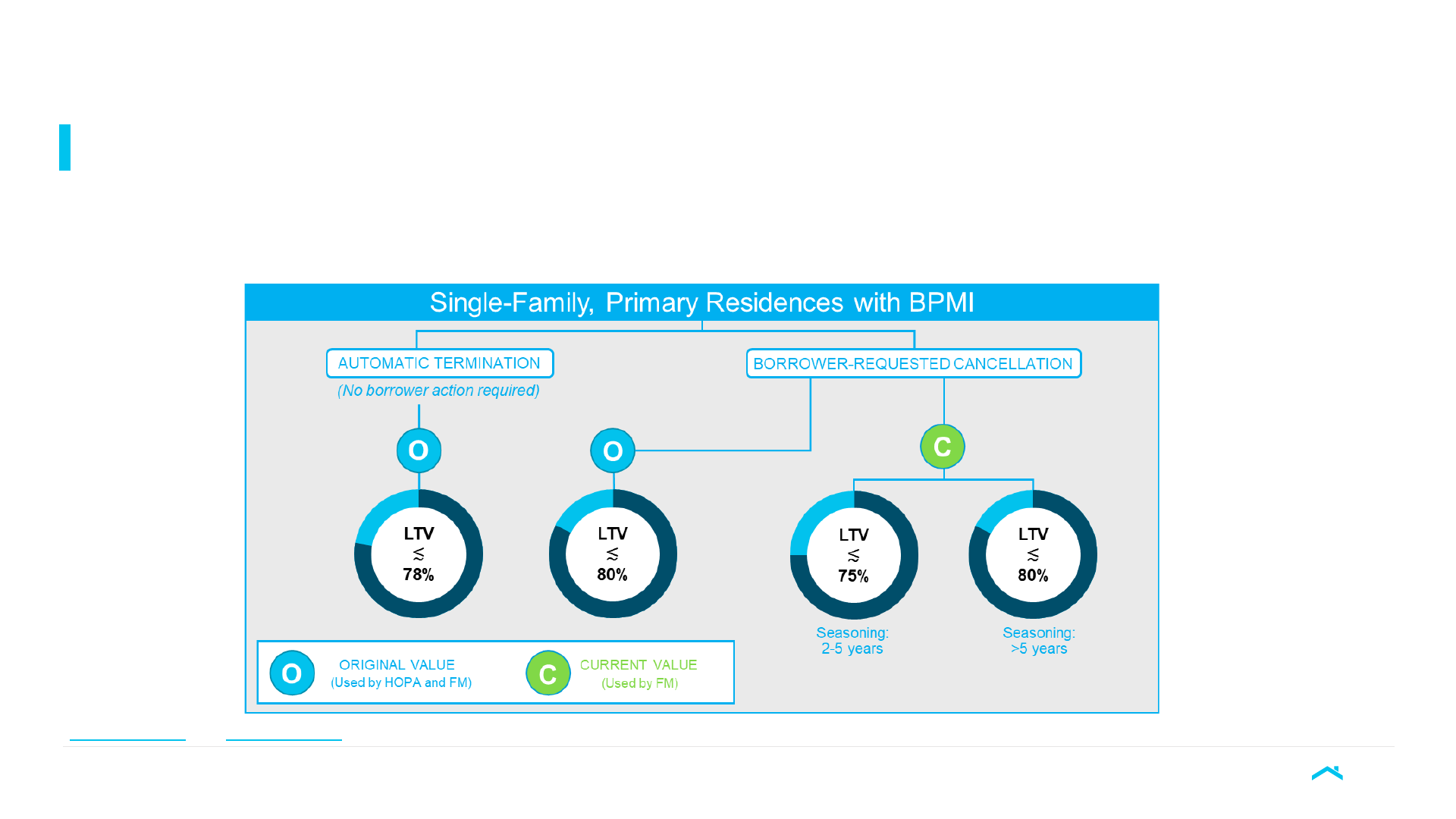

PMI Cancellation Types

Introduction to Private Mortgage Insurance

▪ The Homeowners Protection Act (HoPA) of 1998 established rules for the automatic termination of borrower-paid private mortgage insurance

(BPMI) on certain home mortgages. The HoPA requires that BPMI be automatically cancelled by the servicer when a borrower has built up a

certain amount of equity in their home. Freddie Mac’s Selling/Servicing Guide establishes the criteria for a borrower to request the mortgage

insurance be cancelled.

10

Section 8203.2(a) and Section 8203.2(b) of the Freddie Mac Single-Family Seller Servicer Guide provide more details on requirements and eligibility criteria

PMI Industry Counterparties

Freddie Mac | 2021

Freddie Mac Approved PMI Counterparties

12

PMI Industry Counterparties

▪ Exhibit 10* of the Freddie Mac Single-Family Seller/Servicer Guide provides the list of Freddie Mac-approved

Mortgage Insurers (MIs) that Seller/Servicers may use when a Mortgage sold to Freddie Mac requires mortgage

insurance.

*Active Freddie Mac-approved MIs as of September 2021

PMI Company Overview

Arch Mortgage Insurance The mortgage insurance subsidiary of Arch Capital Group Ltd. (NASDAQ; ACGL), a Bermuda-based, global insurer that writes insurance and

reinsurance on a worldwide basis.

Enact Mortgage Insurance

(Previously Genworth)

Enact, operating principally through its wholly owned subsidiary Genworth Mortgage Insurance Corporation since 1981, is a leading U.S. private

mortgage insurance group Enact is headquartered in Raleigh, North Carolina

Essent Guaranty The principal operating company of Essent Group Ltd. (NYSE: ESNT), a Bermuda-based holding company. Essent offers private mortgage insurance

for single-family mortgage loans in the United States. Essent also offers mortgage-related insurance, reinsurance and advisory services through its

Bermuda-based subsidiary, Essent Reinsurance Ltd.

Mortgage Guaranty Insurance

Corp (MGIC)

The principal subsidiary of MGIC Investment Corporation (NASDAQ: MTG), headquartered in Milwaukee, WI, which provides private mortgage

insurance services. MGIC also provides reinsurance through its wholly-owned subsidiary MGIC Assurance Corp.

National MI (NMI) NMI Holdings, Inc. (NASDAQ: NMIH), is the parent company of National Mortgage Insurance Corporation (National MI), a U.S.-based, private

mortgage insurance company.

Radian Group Radian Guaranty is the primary operating company of Radian Group Inc. (NYSE: RDN), a Philadelphia, PA-based provider of private mortgage

insurance. Radian Group also provides mortgage credit reinsurance through its Radian Reinsurance subsidiary and other real estate settlement

services through its Homegenius division.

Private Mortgage Insurer

Eligibility Requirements

(PMIERs)

Freddie Mac | 2021

PMIERs

14

PMIERs

The Private Mortgage Insurer Eligibility Requirements (PMIERs), developed under the oversight of FHFA, reflects the

aligned GSE requirements that an MI must meet in order to become an approved mortgage insurer and be eligible to

provide mortgage guaranty insurance on loans delivered to or acquired by the GSEs. The PMIERs were made

effective in December 2015 and revised in March 2019.

▪ As a result of the last financial crisis, the GSEs developed an aligned set of counterparty eligibility requirements to

strengthen the operating and financial standards used by the GSEs to manage their counterparty risk exposures to

their mortgage insurance counterparties.

▪ The PMIERs are intended to enhance the safety and soundness of the GSEs as well as provide greater confidence

to market participants and policymakers in the long-term value and role of the MI industry.

▪ The PMIERs establish minimum business and financial requirements a mortgage insurer must meet as well as the

requirements for new companies seeking to apply for approved mortgage insurer status. A key element of the

PMIERs is a loan-level, risk-based framework that determines the Minimum Required Assets that an approved

insurer must hold as of the end of each calendar quarter. The PMIERs also defines Available Assets which are

those liquid, fungible assets that a mortgage insurer can use to meet its Minimum Required Asset requirement.

MI Master Policy and Claims

Process

Freddie Mac | 2021

Master Policy

▪ Master Policy is the Freddie Mac approved form of primary insurance contract defining the terms of MI coverage on eligible loans

that is executed between MI companies and Seller/Servicers. Freddie Mac is the beneficiary of such coverage for loans it has

purchased.

▪ In conjunction with their loan origination process, Seller/Servicers secure MI on behalf of the borrower. The Seller/Servicers

subsequently submit data about the MI coverage to Freddie Mac via Loan Selling Advisor (LSA) at time of loan delivery.

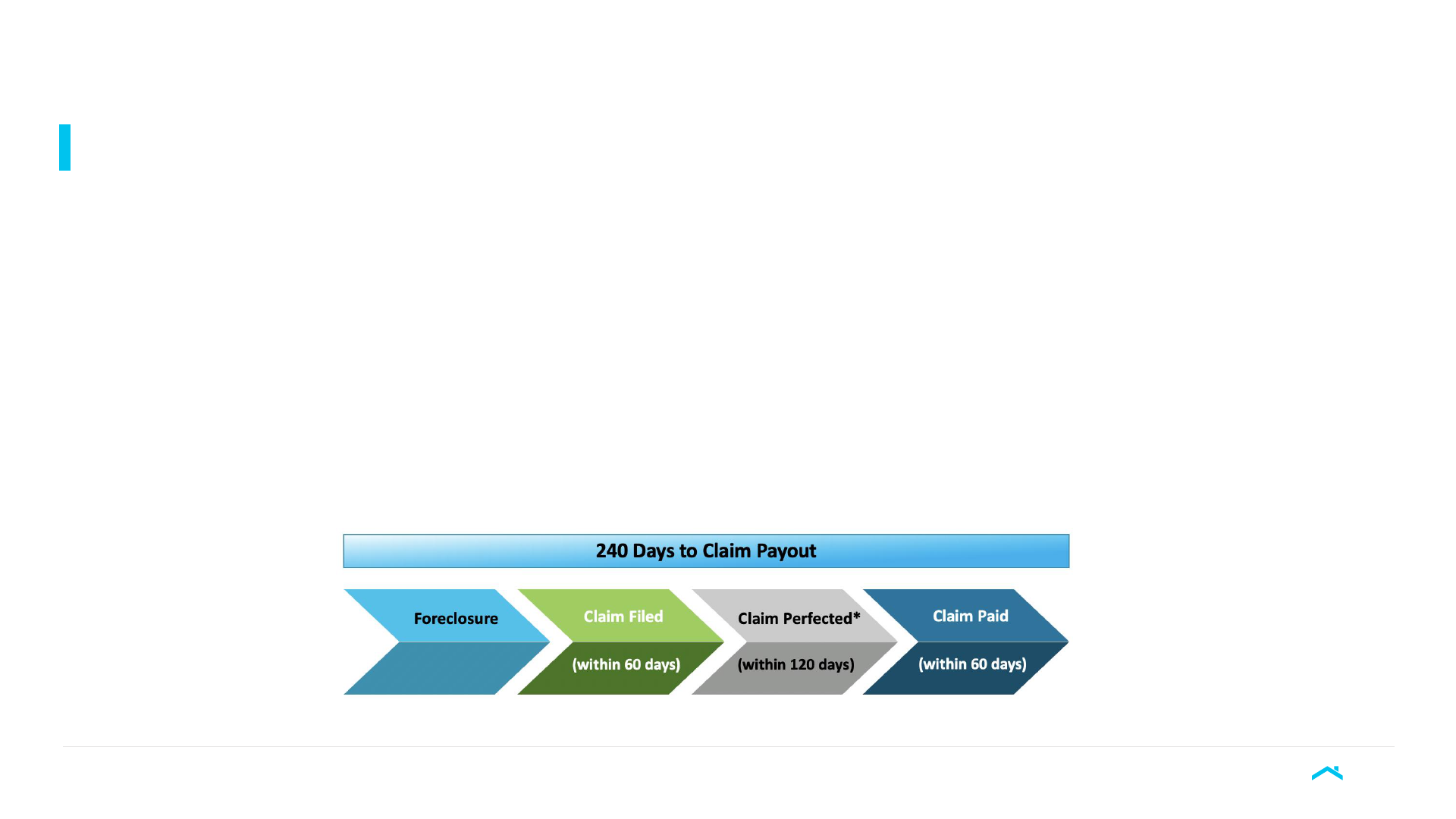

▪ Freddie Mac is responsible for filing claims with the MI company with cooperation from the Seller/Servicers. Pursuant to their

Guide-based obligations, Seller/Servicers provide relevant servicing or foreclosure information, as may be needed by Freddie Mac

or requested by the MI company, typically within 60 days* from the time the loan with MI has had had a claim event (e.g.,

foreclosure sale, deed in lieu or third-party sale).

▪ Generally, the claim filed must be perfected* within 120 days and the payment on the perfected claim is remitted by the MI

company to the beneficiary within 60 days of the perfection date.

16

*Perfected Claim means a Claim received by the MI which contains all information or supporting documentation required by the MI and for which all requirements of the Master Policy applicable to payment of a Claim are

satisfied. Assumes successful claim without curtailment or dispute

Master Policy and Claims

Disclaimer

Freddie Mac | 2021

Disclaimer

18

▪ The foregoing is provided for general informational purposes only. There is no opinion expressed herein; nor does the foregoing

constitute an endorsement or recommendation by Freddie Mac; nor is there the intent to provide counsel or advisory services of

any kind. The information is provided in good faith; however, we make no representation or warranty of any kind, express or

implied, regarding the completeness, adequacy, reliability, suitability, or validity of this information for your use. This is not an

attempt to get you to purchase mortgage insurance, nor should it be viewed as a solicitation to invest in any product or securities

offered by Freddie Mac. You should not rely upon the material or information provided herein as a basis for making any business,

legal or any other decisions. If you have any questions, please seek and consult your own qualified, licensed and knowledgeable

professional for guidance. Any reliance you place on this material is therefore strictly at your own risk.

Disclaimer