U.S. Department of Justice

Policy Statement 1400.04

Part 301-41. Combining Official and Personal Travel.

This part sets forth Department policies on combining official and personal travel. Specifically,

it covers when a traveler can use his or her IBA and contract fares when combining official and

personal travel (41 CFR §§ 301-2 and 301-10).

Section 301-41.010. General Rules.

A traveler may choose to combine official and personal travel, and/or travel by a different mode

of transportation from that authorized. All costs in excess of those incurred for official travel

resulting from personal preference must be borne by the traveler, not the Department.

The traveler must provide evidence (see § 301-10.020) to the travel authorizing official that the

lowest airfare that meets the Department’s mission was used to determine the constructive cost

of the official travel. This evidence may be screen shots from the OBE, which show the fare

options available to the employee, or a signed certification that the lowest airfare that meets the

Department’s mission was used.

Per diem is not allowed when a traveler takes annual leave for more than half the day while on

official travel. Normally, per diem is authorized for the weekend when official travel spans the

weekend. However, if a traveler takes 8 hours of annual leave on both Friday and Monday

before and after a weekend, per diem must not be authorized for the weekend. This also applies

to holidays or other non-workdays.

See Appendix B: Illustrations of Combining Official and Personal Travel, for detailed examples

of combining official and personal travel.

Section 301-41.020. Deviating from the Authorized Mode or Route of Travel.

The travel authorizing official must authorize the most expeditious mode and route practicable.

Destinations, other than those necessary to conduct official business, which are planned for

personal reasons, must not appear on the travel authorization.

A traveler, for personal reasons, may use a mode and/or route other than that authorized.

Reimbursement is limited to the expenses that would have been incurred had the traveler not

changed the authorized mode or route.

A. Deviating from the Authorized Mode of Transportation.

1. Common Carrier.

If a traveler chooses to travel by a POV when travel by common carrier is authorized,

reimbursement is limited to the actual POV mileage, along with other POV-related

expenses such as parking, ferry fees, and tolls, not to exceed the constructive cost of

travel by common carrier, including the constructive cost of travel to and from the

common carrier terminals.

39

Excepts (301-41 and Appendix B) from USDOJ Policy Statement

1400.04 effective July 1, 2014.

Please note, Combining Official and Personal Travel Worksheet

must be submitted 3 weeks prior to course start date.

U.S. Department of Justice

Policy Statement 1400.04

2. Government Owned Vehicle (GOV).

If a traveler chooses to travel by POV when travel by a GOV is authorized,

reimbursement must be based on the constructive mileage rate of a GOV (41 CFR

§ 301-10.310).

3. Privately Owned Vehicle (POV).

If a traveler chooses to travel by common carrier when travel by POV is authorized,

reimbursement is limited to the actual common carrier cost not to exceed the

constructive cost of POV mileage, along with other POV-related expenses such as

parking, ferry fees, and tolls.

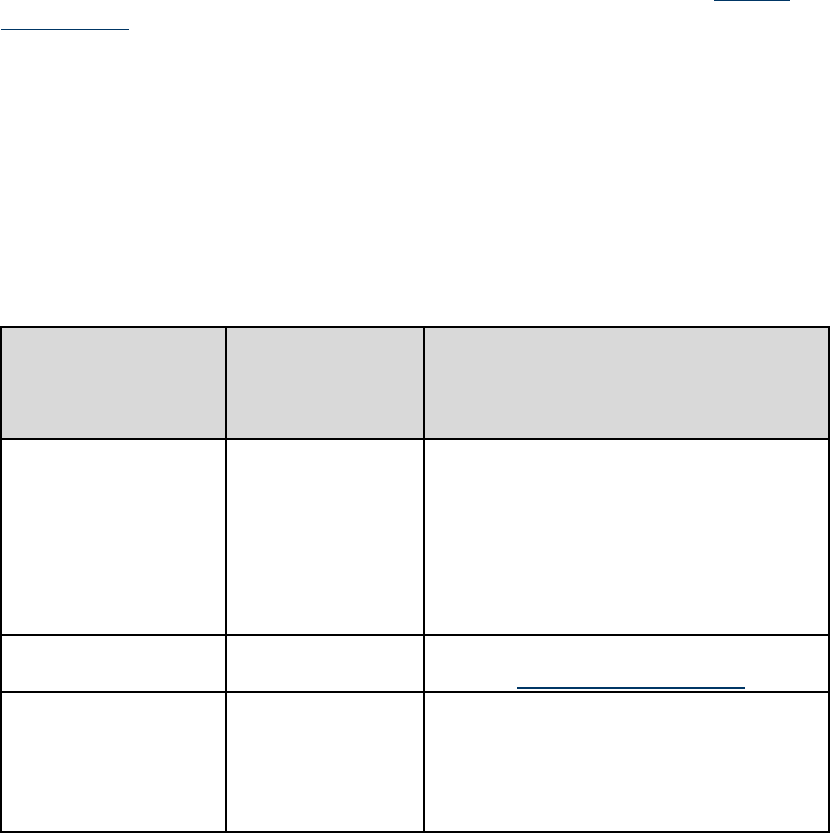

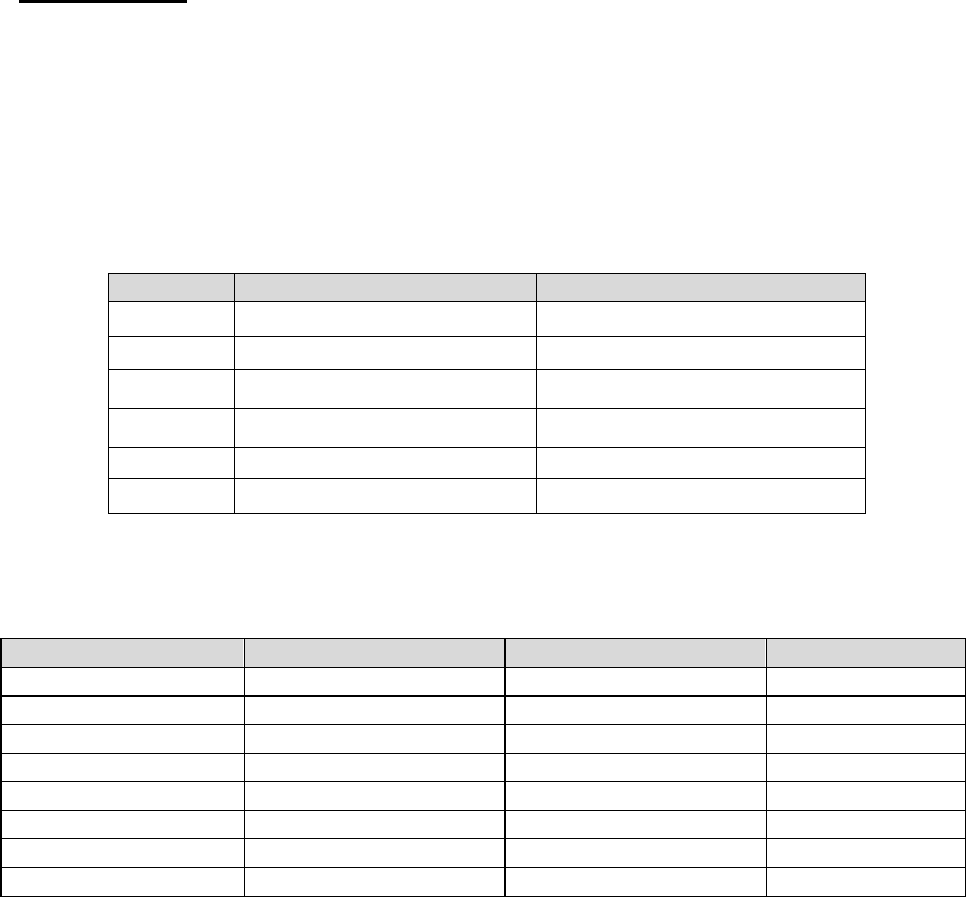

Table 2: Depiction of reimbursement limits if a traveler deviates from the authorized

mode of transportation.

If traveler’s

authorized mode of

transportation is:

And traveler

chooses to use a

different mode

such as:

Then the traveler’s reimbursement

is:

Common Carrier

(e.g., airplane, bus,

rail)

POV Limited to the actual mileage, along

with POV-related expenses, such as

parking, ferry fees, and tolls, not to

exceed the constructive cost of travel

by common carrier including the cost

of local travel to and from the common

carrier terminals.

GOV POV Based on a constructive mileage rate of

a GOV (41 C.F.R. § 301-10.310).

POV Common Carrier Actual common carrier cost, not to

exceed constructive cost of POV

mileage rate plus other POV-related

expenses, such as parking, ferry fees,

and tolls.

B. Deviating from the Authorized Route or the Authorized Itinerary.

A traveler who deviates from the authorized route or interrupts the authorized itinerary,

including interrupting a connecting flight, must not use contract fares, the online booking

engine, or the IBA for routes or itineraries that are not officially authorized.

Example – Deviating from the Authorized Route: A traveler is authorized to travel

from Washington, DC, to Denver, CO, and return using the Government contract fair (the

city-pair is DC/Denver). If on the return trip, the traveler changes this flight to return to

Washington, DC, with a stop in Memphis, TN, for personal reasons, the traveler is

deviating from the authorized route and must not use the contract fare, the online booking

engine, or the IBA for the return trip.

40

U.S. Department of Justice

Policy Statement 1400.04

Example - Deviating from the Authorized Itinerary: A traveler is authorized to travel

from Washington, DC, to Denver, CO, using a Government contract fare (the city-pair is

DC/Denver). The contract fare includes a stop in Dallas, TX. However, the traveler

chooses to stay in Dallas, TX for more than four hours on personal business. In this case,

the traveler will be interrupting the authorized itinerary and breaking the authorized city-

pair. The traveler cannot use the contract fare, the online booking engine, or the IBA for

the return trip.

Section 301-41.030. Making Travel Arrangements for Official and Personal Travel.

When a traveler combines official and personal travel, the travel arrangements for the official

travel must be made through the Department’s TMC. The traveler must use his or her IBA only

for official travel-related expenses, not personal travel-related expenses.

A traveler must not use the online booking engine to make personal travel reservations.

However, a traveler may call the Department’s TMC to make personal travel reservations. When

calling the Department’s TMC to make personal travel reservations, the traveler must:

Inform the TMC that the travel is personal;

Bear all charges and fees associated with the personal travel; and

Use a personal credit card to pay all charges and fees associated with the personal travel.

When travel is to a destination solely for personal reasons, and no official duty is performed at

the destination, a traveler must not use a contract fare or his or her IBA. However, if the traveler

arrives at the TDY location prior to the authorized travel date and/or stays at the TDY location

beyond the authorized departure date for personal reasons, the traveler may still use contract

fares, because the traveler did not deviate from the authorized route.

If on a traveler’s own time, the traveler goes to a different location from the TDY location and

returns to the TDY location, that trip is personal and must not be by contract fare or purchased

with the IBA. The traveler must not claim per diem and other travel expenses for the period of

personal travel. The notation “personal business” on the travel voucher on days for which no

travel expenses are claimed is sufficient.

Section 301-41.040. Rental Vehicles for Combined Official and Personal Travel.

The traveler must not use official rental vehicles for personal travel. If a traveler arrives at the

TDY location early or stays at the TDY location after official travel for personal reasons, the

traveler must contract for the rental vehicle separately for the personal portion of the travel at

personal expense and not use an IBA.

Section 301-41.050. Lodging for Combined Official and Personal Travel.

When lodging is used for combined official and personal travel, a traveler must inform the

lodging facility that a portion of the travel will be for personal reasons. The traveler must use a

41

U.S. Department of Justice

Policy Statement 1400.04

personal credit card, not the IBA, to pay for lodging for personal travel. The traveler may use

the Government rate for personal travel if the hotel offers such rate when the traveler is on

personal travel.

Section 301-41.060. Cancelled or Interrupted Personal Travel.

In some instances, a traveler will have to cancel or reschedule planned personal travel if the

traveler is needed for official duty. If the traveler purchased a non-refundable ticket, or made a

non-refundable deposit, the travel authorizing official may authorize reimbursement for either

the actual costs of the non-refundable item(s) or any applicable change fee. The traveler may

only be reimbursed for unavoidable actual losses incurred due to cancelled or interrupted travel.

Unavoidable actual losses may include costs of non-refundable item(s) purchased by the traveler

for immediate family members, as defined by 41 CFR § 300-3.1.

If a traveler is required to interrupt personal travel and return to the permanent duty station or

perform TDY travel, the travel authorizing official may authorize travel from the personal travel

destination point to the permanent duty station or the TDY location, and, if applicable, from the

TDY location back to the personal travel destination point or the permanent duty station. The

traveler may use the contract fares and his or her IBA for this travel.

A. Non-refundable tickets.

It is possible that an unused personal ticket either may be used later or cannot be used at

all. If the ticket cannot be used at all, the traveler must attach the unused ticket, if

available, when claiming reimbursement. If a ticket is not available, the traveler must

provide evidence of cost and cancellation.

If the traveler can use the ticket at a later time and there is an associated change fee, the

travel authorizing official may authorize reimbursement of the change fee when the

traveler incurs the change fee expense.

If the airline increases the cost of the original ticket, the travel authorizing official may

authorize reimbursement of the difference in cost. However, if the traveler elects a more

costly class of travel than the original ticket (e.g., selects business-class instead of coach-

class), the traveler must bear the additional cost.

B. Non-refundable deposits.

When claiming reimbursement for a non-refundable deposit, the traveler must provide

evidence of the cost of the deposit and the cancellation.

42

U.S. Department of Justice

Policy Statement 1400.04

APPENDIX B: COMBINING OFFICIAL AND PERSONAL TRAVEL

Illustration 1: DIRECT, ONE TDY LOCATION

Felix is authorized to travel from Washington, DC, to Los Angeles, CA, to work on a trial. The

trial is scheduled to last 2 weeks (July 18 through July 29). Felix is authorized to travel on July

17 and 30 respectively so that he is available for the entirety of the trial. He is also authorized to

use a non-contract fare for his departing flight to Los Angeles since the trial start date is fixed,

but is required to use the Contract City Pair fare (_CA fare if available) for his return flight

because the trial’s end date is very uncertain and the penalty for changing this non-contract fare

is $150. This makes the expected cost of the non-contract fare more expensive than the _CA fare

ticket (Non-

utilize the benefits of the _CA fare, he will purchase two one-way tickets for his departure and

return flights respectively, because if he combines the contract and non-contract fares, the entire

itinerary will change to a non-contract fare.

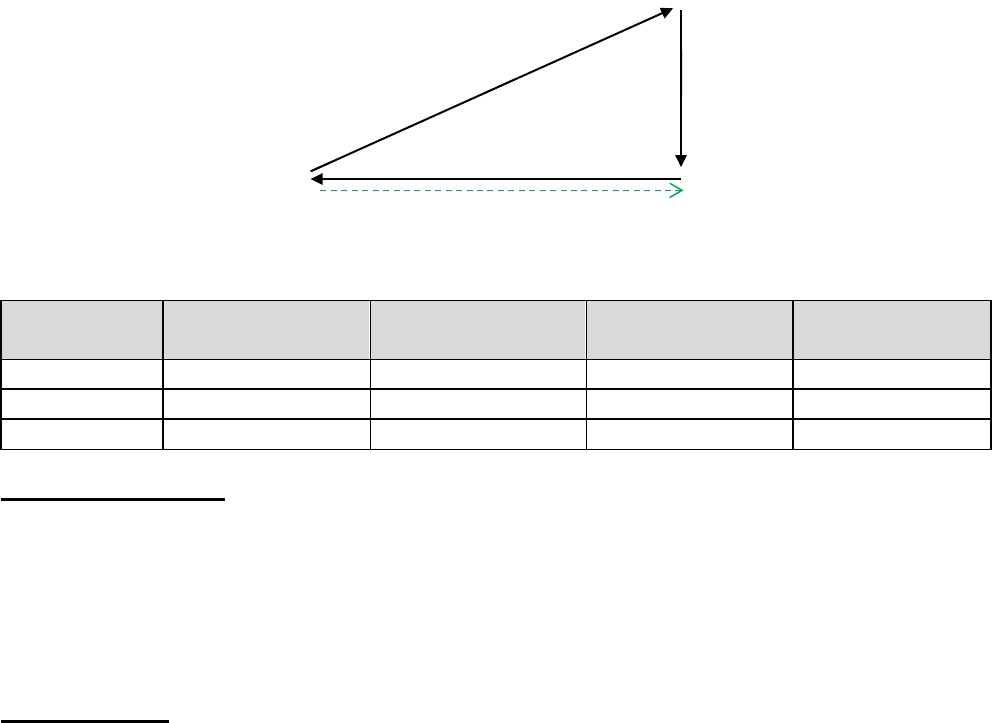

Figure 2: Diagram of Official Travel to One TDY Location – Direct.

Table 4: One-Way Fare Costs for Official Travel – Direct.

Fare Flight 1A Official: DC to CA Flight 1B Official: CA to DC

_CA $400.00 $400.00

YCA $500.00 $500.00

Non-Contract $275.00 $350.00

Travel Authorization.

Felix is authorized to use a non-contract, non-refundable ticket for his departing flight, and a

_CA fare for his return flight. The airfare amount authorized for this trip is $675 (Flight 1A

($275) + Flight 1B ($400)).

Travel Voucher.

The travel voucher must include the receipts for the airline tickets used. The airfare amount

claimed for this trip is $675 (Flight 1A ($275) + Flight 1B ($400) = $675).

Table 5: Per Diem Calculation for Official Travel – Direct.

Travel Days M&IE Lodging Per Diem

July 17 (First Day) $71 * 75% = $53.25 $133.00 $186.25

July 18 to July 29 $71 * 12 days = $852.00 $133 * 12 days = $1,596.00 $2,448.00

July 30 (Last Day) $71 * 75% = $53.25 $0.00 $53.25

Total $958.50 $1,729.00 $2,687.50

1 A

1 B

Washin

g

ton

,

DC

Los Angeles, CA

57

U.S. Department of Justice

Policy Statement 1400.04

Illustration 2: COMBINED OFFICIAL AND PERSONAL TRAVEL, ONE TDY

LOCATION

Felix is on official travel from Washington, DC, to Los Angeles, CA, for trial. The trial is

scheduled to last two weeks (July 18 through July 29). His travel dates are July 17 and 30

respectively. He is authorized to use a non-contract fare for his departing flight to Los Angeles

since the trial start date is fixed, but is required to use the Contract City Pair fare (_CA fare if

available) for his return flight because the trial’s end date is very uncertain and the penalty for

changing this non-contract fare is $150. However, Felix plans to take annual leave after the trial

and fly directly to Augusta, ME on July 30 to visit his family. In this case, Felix is not allowed

to use Contract City Pair fares or his IBA for his trip from Los Angeles to Augusta and from

Augusta to Washington because it is personal travel.

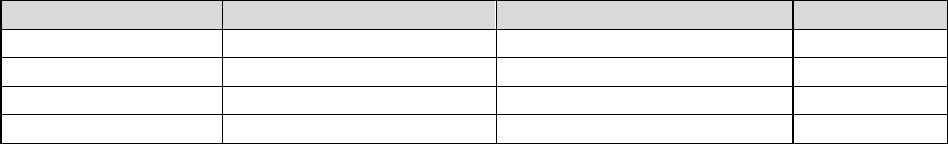

Figure 3: Diagram of Combined Official and Personal Travel to One TDY Location.

Table 6: One-Way Fares for Combined Official and Personal Travel to One TDY Location.

Fare Fli

g

ht 1A Official:

DC to CA

Flight 1B Official:

CA to DC

Flight 2 Personal:

CA to ME

Fli

g

ht 3 Personal:

ME to DC

_CA $400.00 $400.00 Can’t Use Can’t Use

YCA $500.00 $500.00 Can’t Use Can’t Use

Non-Contract $275.00 $350.00 $300.00 $175.00

Travel Authorization.

Felix has been authorized to use non-contract fare for his departure flight, and Contract City Pair

fare for his return flight. It is appropriate to authorize non-contract fare for the departure flight

because the travel dates are set and not likely to change and this is less costly than using the

Contract City Pair fare. The airfare amount authorized for this trip is $675 (Flight 1A ($275) +

Flight 1B ($400) = $675).

Travel Voucher.

The travel voucher must include the receipts. The amount that can be reimbursed is the actual

cost of the tickets used not to exceed what was authorized. In this case Felix’s total actual cost is

Augusta, ME

2

3

Washington, DC

1A

Los Angeles, CA

1B

58

U.S. Department of Justice

Policy Statement 1400.04

$750 (Flight 1A ($275) + Flight 2 ($300) + Flight 3 ($175) = $750). Felix may be reimbursed up

to the amount authorized, which is $675.

Table 7: Per Diem Calculation for Combined Official and Personal Travel to One TDY

Location.

Travel Days M&IE Lodging Per Diem

July 17 (First Day) $71 * 75% = $53.25 $133.00 $186.25

July 18 to July 29 $71 * 12 days = $852.00 $133 * 12 days = $1,596.00 $2,448.00

July 30 (Last Day) $71 * 75% = $53.25 $0.00 $53.25

Total $958.50 $1,729.00 $2,687.50

59

U.S. Department of Justice

Policy Statement 1400.04

Illustration 3: COMBINED OFFICIAL AND PERSONAL TRAVEL

TWO TDY LOCATIONS

Mary is authorized to travel from her permanent duty station (PDS) of Washington, DC, to Los

Angeles, CA, and then to Pittsburgh, PA. She is authorized to travel to Los Angeles on Sunday,

July 17 and be there through the morning of Saturday, July 23. Mary is authorized to go directly

to Pittsburgh from Los Angeles since it is more cost effective than going back to Washington

before traveling to Pittsburgh.

Mary decides that she would rather spend the weekend in Augusta, ME than in Pittsburgh, PA,

so she plans to take a personal trip from Los Angeles to Augusta, and then on the morning of

Monday July 25 she will fly from Augusta to Pittsburgh. She will complete her official duties in

Pittsburgh on July 30 and then fly back to Washington.

Mary is authorized non-contract fares for her official trip from Washington to Los Angeles, Los

Angeles to Pittsburgh, and Pittsburgh back to Washington since it is more cost effective and

dates are fixed.

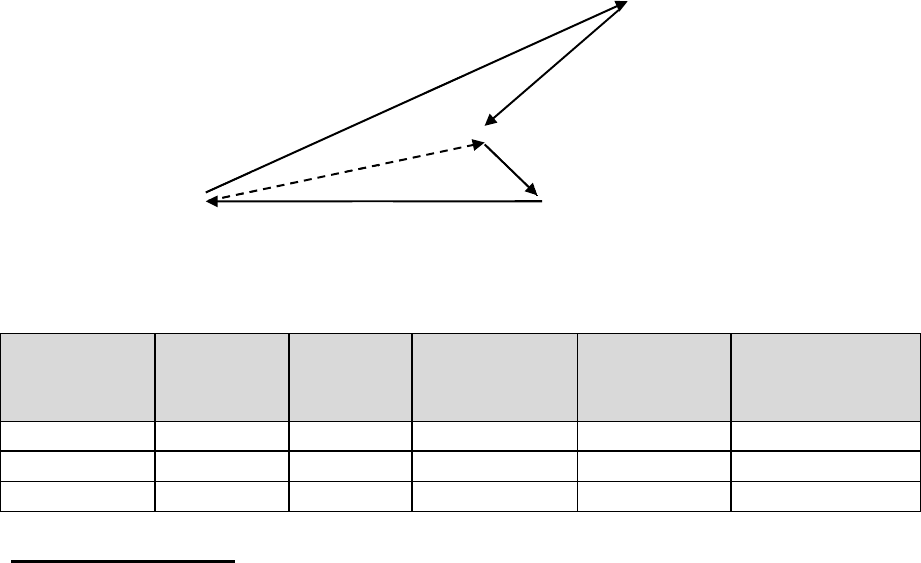

Figure 4: Diagram of Combined Official and Personal Travel to Two TDY Locations.

Table 8: One-Way Fares for Combined Official and Personal Travel to Two TDY Locations.

Fare Flight 1A

Official:

DC to CA

Flight 2

Official:

CA to PA

Flight 3

Official:

PA to DC

Flight 4

Personal:

CA to ME

Flight 5:

Personal:

ME to PA

_CA $400.00 $430.00 $240.00 Can’t Use Can’t Use

YCA $500.00 $525.00 $250.00 Can’t Use Can’t Use

Non-Contract $275.00 $300.00 $175.00 $350.00 $200.00

Travel Authorization.

The travel authorization must include only the destinations and airfare that are authorized, not

personal destinations. Since non-contract fares are authorized for her entire official travel, the

Augusta, ME – Personal

Destination – 7/23 -7/25

Pittsburgh, PA – TDY

7/25-7/30

5

3

Washington, DC - PDS

Los Angeles – TDY

7/17 – 7/23

2

1

4

60

U.S. Department of Justice

Policy Statement 1400.04

amount to put on her travel authorization is $750 (Flight 1($275) + Flight 2 ($300) + Flight 3

($175) = $750).

Travel Voucher.

The amount to reimburse Mary for her airfare is the actual amount she paid, which in this case is

$1,000 (Flight 1 ($275) + Flight 4 ($350) + Flight 5 ($200) + Flight 3 ($175) = $1,000), not to

exceed the amount authorized for official travel, which is $750 (Flight 1 ($275) + Flight 2 ($300)

+ Flight 3 ($175) = $750). Since she was authorized the non-contract fare, the non-contract fare

is what is used for cost comparison purposes.

Table 9: Actual Expenses versus Authorized Amount for Combined Official and Personal

Travel to Two TDY Locations.

Flight # Actual Expense Authorized Amount

1 $275.00 $275.00

2 $0.00 $300.00

3 $175.00 $175.00

4 $350.00 $0.00

5 $175.00 $0.00

Total $1000.00 $750.00

Table 10: Per Diem Calculation for Combined Official and Personal Travel to Two TDY

Locations.

Travel Days M&IE Lodging Per Diem

July 17 (First Day) $71 * 75% = $53.25 $133.00 $186.25

July 18 to July 22 $71 * 5 days = $355.00 $133 * 5 days = $665.00 $1,020.00

July 23 $71 * 75% = $53.25 Not Reimbursable $53.25

July 24 (Personal Day) Not Reimbursable Not Reimbursable Not Reimbursable

July 25 $71 * 75% = $53.25 $125 * 1 day = $125.00 $178.25

July 26 to July 29 $71 * 4 days = $284.00 $125 * 4 days = $500.00 $784.00

July 30 (Last Day) $71 * 75% = $53.25 $0 $53.25

Total $852.00 $1,423.00 $2,275.00

61